Fixed income has become an investable asset class again

- 10 May 2022 (7 min read)

Returns on most fixed income assets so far this year have been the worst in most investors’ memories. The flip side is that after many years of low, and even negative, yields, fixed income now offers a more attractive yield than it has for some time.

Three reasons to be constructive on fixed income

Valuations

The market is now pricing in a material amount of interest rate rises and has re-adjusted for today’s materially higher inflation environment. Even if we might argue that some central banks have been behind the curve, the bond market is not. Obviously, the bond market is the curve and has gone some way to pricing in future rate hikes. With higher government bond yields has come wider credit spreads, meaning that valuations have also improved further down the credit curve.

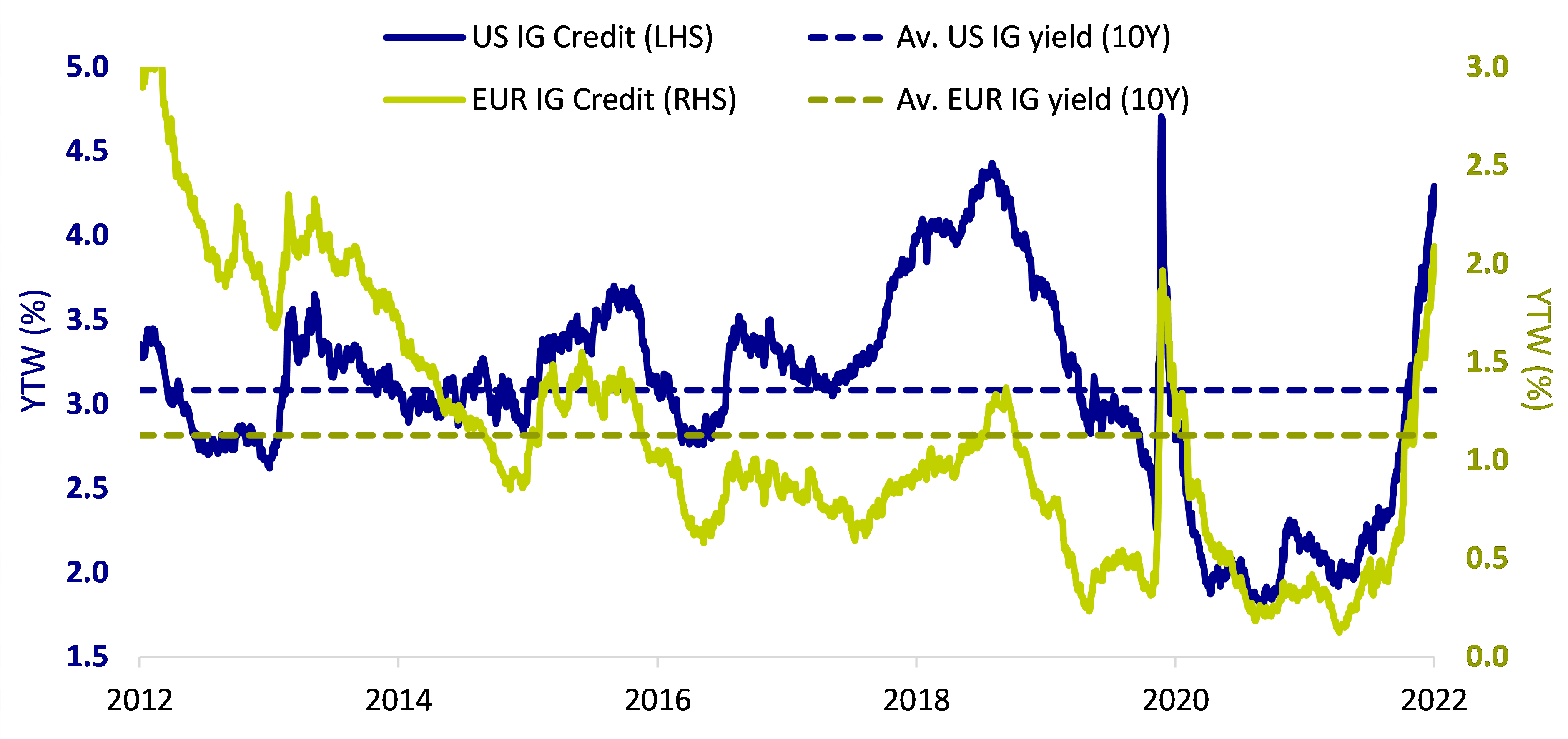

Taking investment grade credit markets as an example, which have been hardest hit in 2022 due to their sensitivity to both rates and spreads, yield levels in both the US and Europe are now higher today than their respective 10-year averages – as highlighted in the chart below.

Investment grade credit yields now higher than 10-year averages

Source: AXA IM, Bloomberg as at 30/04/2022

Economic outlook

In addition to the valuation argument, it is important to remember how the economic cycle works. The US Federal Reserve (the ‘Fed’) is raising rates to slow the economy and tackle persistently high inflation.

There is no question that the global economy has heated up as COVID-related restrictions have lifted, particularly in the US. But the bond market is more interested in the future state of the economy than the one we observe today.

With high inflation, rising interest rates and the heightened cost of living, it is entirely plausible that in 12 or 18 months’ time the economy will be weaker, and the tighter financial conditions brought about by higher interest rates may lead to a slowdown. Needless to say, the speed and extent of that slowdown is a point of much debate, but we can conclude that bonds typically perform better when expectations shift towards an easing of monetary policy.

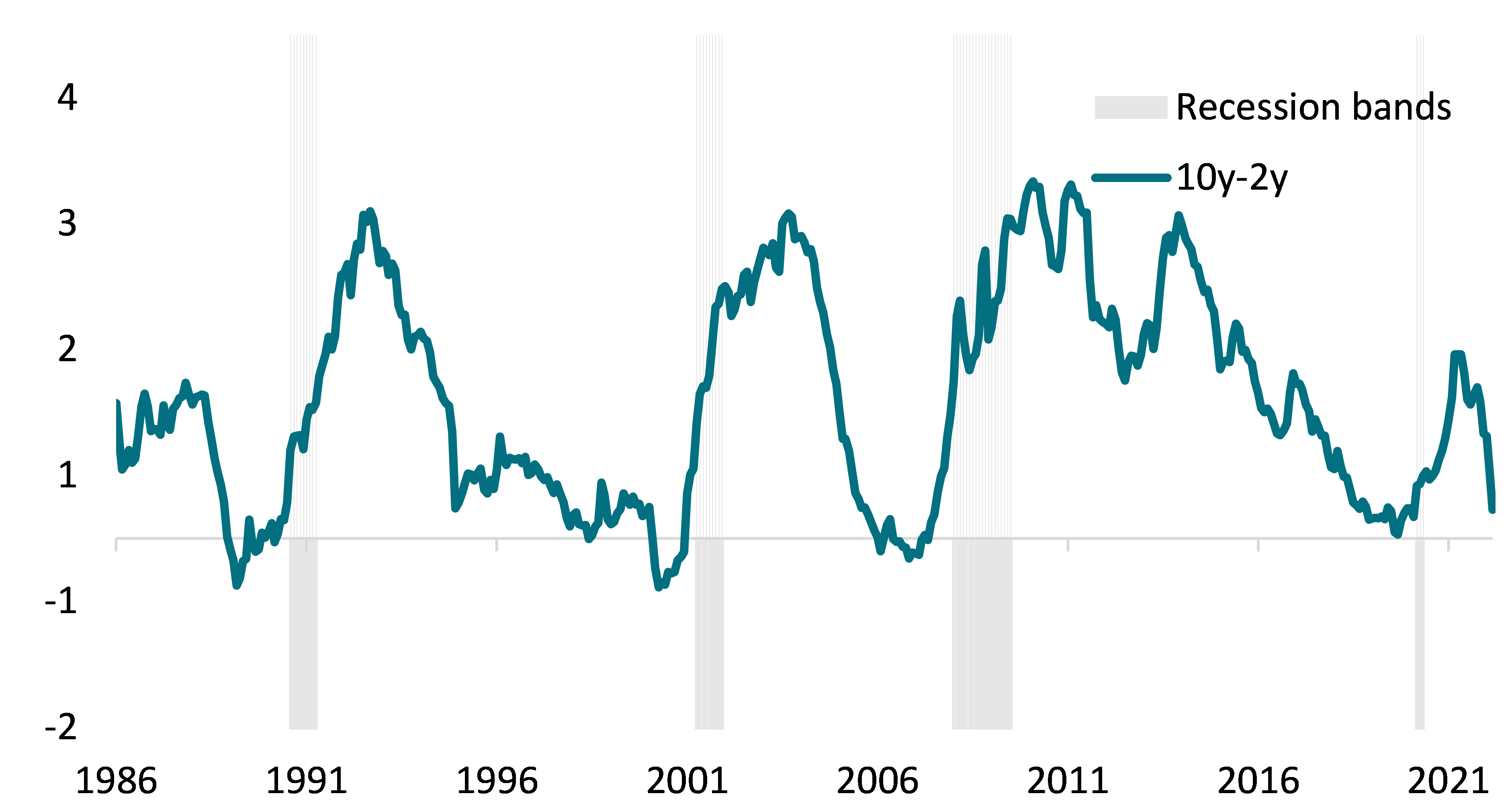

A couple of significant recession warning indicators have been flashing recently. The first of these relates to the recent spike in oil price. Historically, not every spike in oil price has led to a recession but, it is fair to say that every recession has tended to be preceded by a spike in oil price. Secondly, the shape of the yield curve, which inverted recently in the US (i.e. US 2-year Treasury yields moved higher than 10-year equivalents), has historically been a pretty foreboding signal of a recession to come, as indicated by the chart below.

US “2s 10s” curve and recessions

Source: AXA IM, Bloomberg. Monthly data as at March 2022

Despite these warning signals, we would stop short of predicting an imminent global recession. However, we do strongly believe that the economy will be weaker in 12-18 months’ time than it is today, certainly in some parts of the world more than others. This could mean a lowering of interest rate expectations and, potentially, a good environment for bond returns.

Buyers coming back

The final leg of our increasingly constructive view on fixed income comes down to portfolio positioning. Given that yields have been low for so long, it is maybe not a surprise that many investors have shied away from fixed income. We believe now that the asset class is more attractive, we could see new buyers coming back to fixed income and closing their underweight positions. Perhaps we are not quite there yet and we need inflation prints to have peaked, or to be further along the Fed rate hiking cycle, but we argue that fixed income should now start to compete for capital once more. A perspective that is in stark contrast to the TINA (There Is No Alternative – to equities) view of the last few years which argued that fixed income was not competitive.

No need to time the market

A market can be cheap, but it doesn’t necessarily follow that it has to get more expensive. The phrase that “markets can stay irrational longer than you can stay solvent” is one well worth remembering, but in fixed income the carry (yield) at some stage becomes too powerful to ignore.

Carry can be so powerful that it is possible for yields to rise and still to make money in bonds, although we are probably not at those extreme valuation levels – yet. That said, current yields are pricing in a decent amount of inflation and rate hikes and at some stage, buyers will want to take the other side of that view.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.