Black Friday and Cyber Monday: E-Commerce against a backdrop of high inflation

- 24 November 2022 (5 min read)

Black Friday and Cyber Monday: E-Commerce against a backdrop of high inflation

Black Friday, the Friday after US Thanksgiving, has become one of the biggest days for online retail around the world. Alongside Cyber Monday - the Monday following US Thanksgiving - the two events have evolved into a month-long period of sales, marking the beginning of the holiday shopping season.

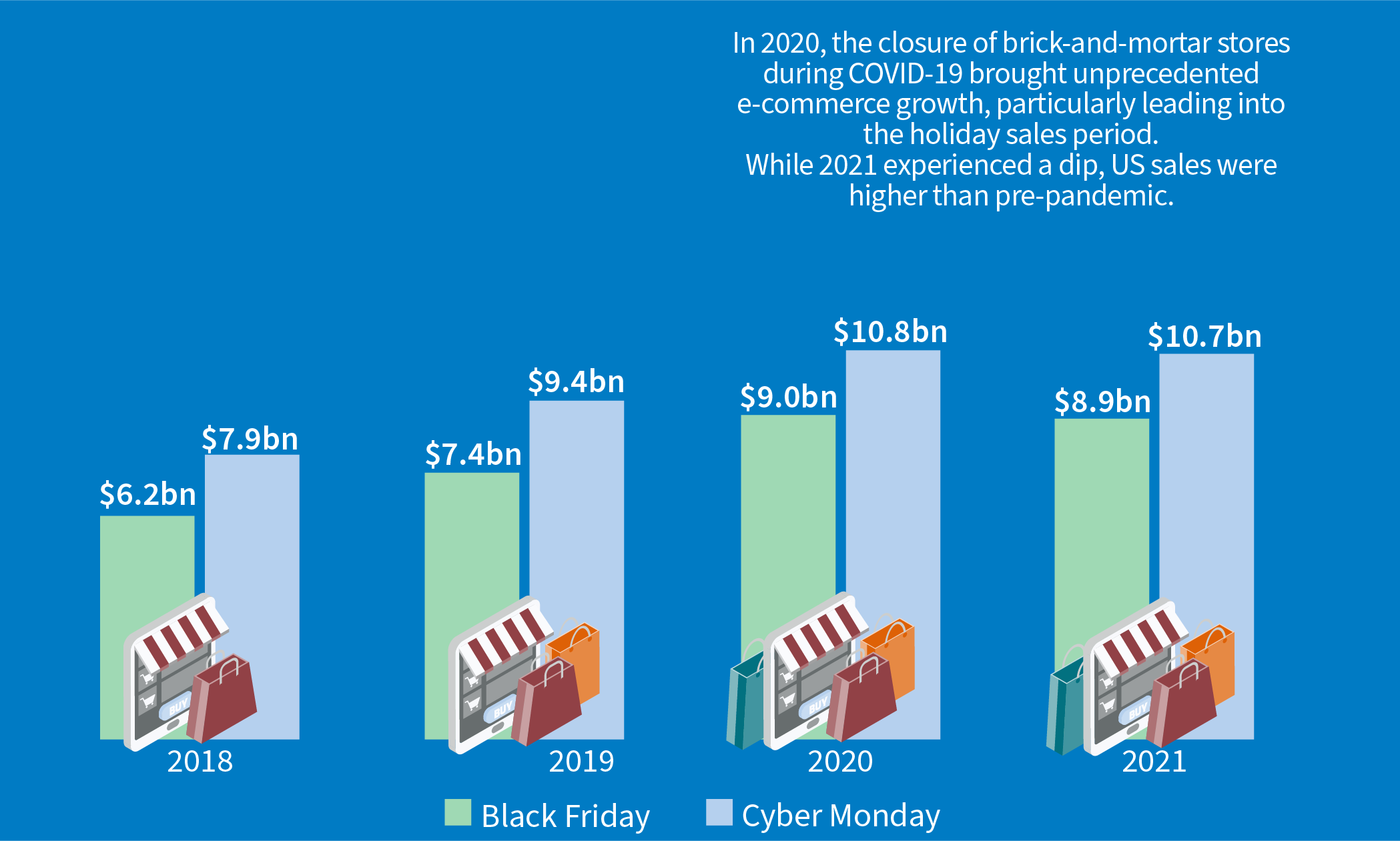

US Black Friday and Cyber Monday sales

Source: Adobe Insights 2019, 2020, 2021

Black Friday and Cyber Monday in 2022

Against a backdrop of high inflation and a cost-of-living squeeze, retailers operating on Black Friday and Cyber Monday this year may feel the effects of supply chain issues, rising costs and decreased consumer spending. However, we believe the long-term growth prospects of e-commerce remain intact, especially as the world becomes increasingly digital.

|

Image

|

Year-on-year nominal growth 7.5%E-commerce and mail-order sales will account for 55% |

E-commerce penetration has continued to rise

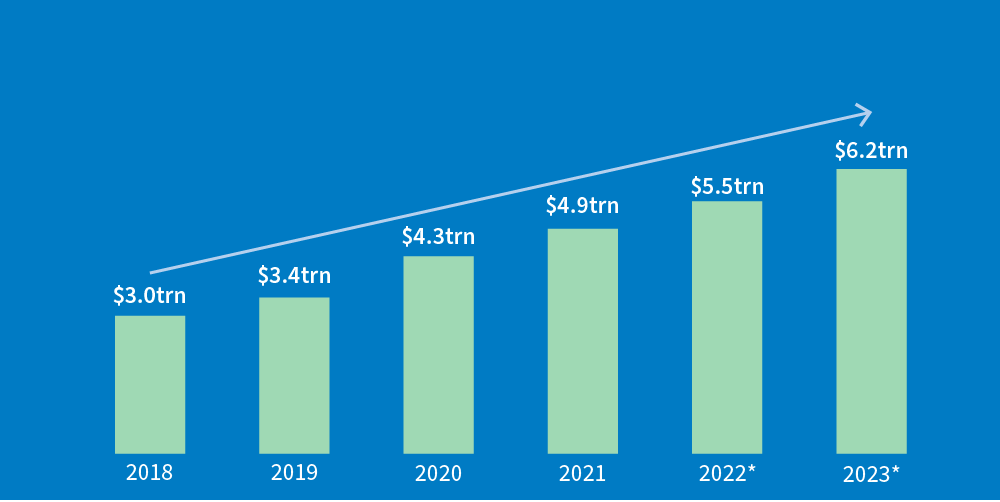

We see the rise in Black Friday and Cyber Monday sales in previous years as part of a bigger picture of growth in global retail e-commerce.

Global retail e-commerce sales

Source: Global retail e-commerce sales 2026, Statista. Note: Figures for 2022 and 2023 are forecasts.4

E-commerce rose from 15% of total global retail sales over 2019 to 21% in 2021. It now sits at an estimated 22% of sales.5 |

An evolving consumer landscape

The COVID-19 pandemic, technological advancements and cost-of-living pressures have served to drastically transform the landscape of retail and commerce.

|

Image

|

58%of internet users make online purchases each week.6 74%of internet users in the EU shopped online for personal consumption in 2021.7 |

While the rising cost of living and its impact on consumer spending will be a headwind for businesses, we see e-commerce continuing to grow as a result of key structural changes in consumer behaviour and the ongoing digitalisation of the economy.

Companies that are agile and able to adapt to the current environment, while harnessing the power of data to be more productive and efficient, are more likely to see good growth.

Jeremy Gleeson, CFA

Digital Economy strategy manager

Sources:

- [1] Adobe: Consumers spent $10.8 billion on Cyber Monday, $109.8 billion so far this holiday season | Adobe

- [2] 11 Black Friday and Cyber Monday Online Retail Stats - SaleCycle

- [3] Will Amazon Deliver Its Usual Holiday Growth? | Bain & Company | 2022 Holiday Shopping Outlook | Bain & Company

- [4] Global retail e-commerce sales 2026 | Statista

- [5] Global Ecommerce Growth Forecast 2022 | Morgan Stanley

- [6] Digital 2022: Global Overview Report — DataReportal – Global Digital Insights

- [7] Online shopping ever more popular - Products Eurostat News - Eurostat (europa.eu)

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.