Investing in Biodiversity

New nature-related policies and regulation being developed will drive new investment opportunities as corporates commit to biodiversity positive business models.

Why consider investing in biodiversity?

New nature-related policies and regulation being developed will drive new investment opportunities as corporates commit to biodiversity positive business models.

Consumers, governments and companies have realised the urgency and we are seeing:

- Consumers consumption patterns changing - deploying money into brands perceived as doing better on environmental issues such as biodiversity protection and restoration

- Corporates have clear economic opportunities to help mitigate their ecosystem damage. Companies who can deliver solutions to help in mitigating biodiversity impact via their innovations will keep investing in research and development to develop new technologies.

How we can act for biodiversity protection

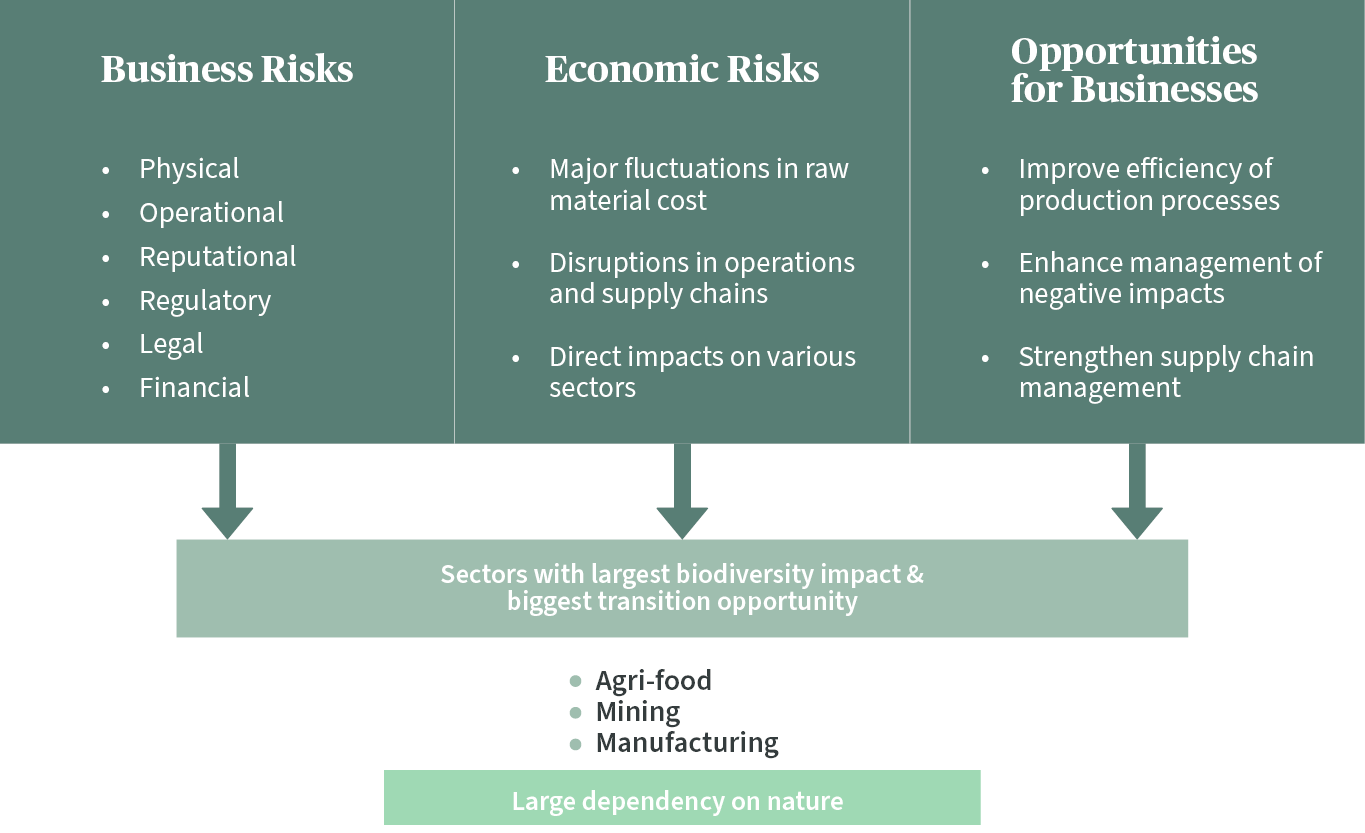

Opportunities and risks

Source: AXA IM. For illustrative purposes only

Biodiversity decline leads to large-scale environmental and social costs, currently costing the global economy 10% of its output each year1. Strategic investments by companies are needed to restore and protect biodiversity on a global scale. It is perhaps useful to think of awareness of the biodiversity crisis being at a similar point to climate about 10 years ago.

- Source: UNEP, 27 May 2021.

Our Biodiversity Strategy

Our Biodiversity Strategy is designed for long-term investors who wish to pursue responsible growth by identifying those listed opportunities which can achieve a measurable and effective impact on the preservation of life on land, water and air. Allocating capital in this way can help to recognise, drive, and incentivise those companies with a material and demonstrable mission to develop sustainable alternative products and services - those needed for the increasingly urgent movement to protect, preserve and support our planet’s ecosystem.

AXA IM’s impact investment expertise aims to hone the Strategy’s focus onto companies which have the strongest potential to promote the UN Sustainable Development Goals most relevant to the Biodiversity theme: UN SDG 6 – Clean Water and Sanitation for all; UN SDG 12 – Responsible Consumption & Production, UN SDG 14 – Life Below Water, UN SDG 15 – Life on land2:

- 6 – Clean Water & Sanitation (Ensure availability and sustainable management of water and sanitation for all)

- 12 – Responsible Consumption & Production (Ensure sustainable consumption and production patterns)

- 14 – Life Below Water (Conserve and sustainably use the oceans, seas and marine resources for sustainable development)

- 15 – Life on land (Protect and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, and halt and reverse land degradation and halt biodiversity loss)

The targeting of specific SDGs does not imply the endorsement of the United Nations of AXA Investment Managers, its products or services, or of its planned activities and does not constitute, explicitly or implicitly, a recommendation for an investment strategy.

The strategy invests in a diversified opportunity set across the areas of sustainable materials, land and animal preservation, water ecosystems, recycling and recirculation. We achieve this by investing across four key areas:

- Sustainable materials

- Land and animal preservation

- Water ecosystems

- Recycling and recirculation

- The targeting of specific SDGs does not imply the endorsement of the United Nations of AXA Investment Managers, its products or services, or of its planned activities and does not constitute, explicitly or implicitly, a recommendation for an investment strategy.

Data driven, reliable Biodiversity impact targets

Investing for material positive impact has previously been hampered by lack of tangible and credible data points. The increasing urgency of systemic biodiversity risk is now driving the creation and development of sophisticated metrics which enable AXA IM investment expertise to select companies that show evidence of having the strongest potential to contribute to achieving our target SDGs.

AXA IM’s partnership with Iceberg Data Lab (IDL) reports the kind of information that can inform portfolio construction and allow clear comparisons. The key datapoint known as Corporate Biodiversity Footprint (CBF) uses as a metric ‘mean species abundance’, or MSA. This employs a life-cycle analysis model to track product flows through the value chain from sourcing to end user and examines four specific pressure points that may be a factor in biodiversity loss: land use; climate change; water pollution; and air pollution. Other inputs may be missing, such as invasive species, but we believe MSA still gives a useful estimate of the square kilometres of pristine forest that would be lost each year given the nature and impact of a company’s activities.

Corporate biodiversity action is at an early stage – the initial focus is driving preservation and mitigation. Our engagement is therefore focused on helping management to understand how to measure their impact and find the key performance indicators that will allow them to monitor their actions in term of biodiversity loss mitigation, and to meet regulatory demands in the future.

Our impact strategies

Our impact strategies are designed to enable our clients to invest in the companies and projects leading the transition to a more sustainable world. These strategies aim to deliver a dual objective (of equal importance) of financial returns and positive & measurable environmental and/or social impact.

Clean Economy

Innovative companies are creating solutions to address pressures on scarce natural resources and the need for greenhouse gas emission reduction.

Green bonds

Green bonds are among the most interesting innovations of the last decade in the field of socially responsible investment products.

Multi-asset impact investing

A world of opportunities to help create a positive impact for people and planet while generating returns.

Social progress

Invest in the companies providing strong social utility by making essential products and services better quality, more affordable and more accessible to all.

Risk warning

Investment in equities involves risks including the loss of capital and some specific risks such as counterparty risk, derivatives, geopolitical risk and volatility risk. Some strategies may also involve leverage, which may increase the effect of market movements on the portfolio and may result in significant risk of losses.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)

__________________________________________________________________________

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.