Global Factor Views - January 2022

Macroeconomic and equity market backdrop

Growth

We expect fading virus concerns to allow the post-covid economic rebound to persist despite continued supply pressures and less favourable monetary conditions compared to 2021. We expect global GDP to grow by 4.2% in 2022 and by 3.6% in 2023.

Inflation and Rates

Near term rising headline inflation, ongoing ‘inflation anxiety’ due to supply chain disruption and a more hawkish Fed is likely to put further upward pressure on both nominal and real US bond yields. While inflationary pressures could ease in the second half of 2022, we expect most Central Banks to tighten their monetary stance during 2022.

Elevated risks

We face increased growth and policy risks. Central banks face a challenging balancing act of managing inflation while avoiding acting too fast and stifling growth. Risks are compounded because current supply chain disruptions are without precedent and Covid has not gone away.

Equity markets

Overall we maintain a cautiously positive stance on equities as economic growth remains supportive of corporate revenue growth and valuations remain attractive compared to bonds. However, we do not expect a repeat of the double digit returns of last year in 2022. We believe a cautiously positive stance is appropriate to reflect elevated economic and policy risks and because rising costs may translate to margin pressure which suppresses earnings growth.

Given this back drop we update our outlook for equity market factors below.

|

Quality Positive |

Against a backdrop of rising macro risks and ongoing supply chain disruptions which may lead to margin pressures, investors are likely to favour companies with a strong track record of earnings delivery. As such we maintain our overweight stance on quality. We do note that some areas of quality remain expensive and would advocate for an active approach to avoid expensive quality stocks |

|

Low Volatility Neutral |

Rising inflation and higher bond yields typically weigh on the performance of the low volatility factor particularly via the factor’s exposure to bond proxies. However, we maintain a neutral stance because the interest rate environment in the months ahead carries with it elevated growth and policy risks which increases the prospect of bouts of risk-off behaviour, which typically favours lower volatility stocks. |

|

Value Positive |

Value remains cheaper than normal. The prospect of higher real and nominal bond yields should be supportive of value styles and may put pressure on the most expensive growth names. We upgrade our outlook on value to positive but do advocate a focus on ‘quality-value’ names due to elevated growth and policy risks in the months ahead. |

|

Momentum Negative |

We remain cautious of trailing measures of share price movement as a predictor of future returns, especially when the elevated growth and policy risks may result in bouts of risk on and risk off behaviour. Within the spectrum of momentum signals, near-term earnings revisions are likely to be a better gauge of market sentiment. |

Source: AXA IM, January 2022. The views expressed above are as of the date of this document. No guarantee or warranty is made regarding the outlook above. Investors should not base their investment decisions on the commentary provided and should consult their advisers before doing so.

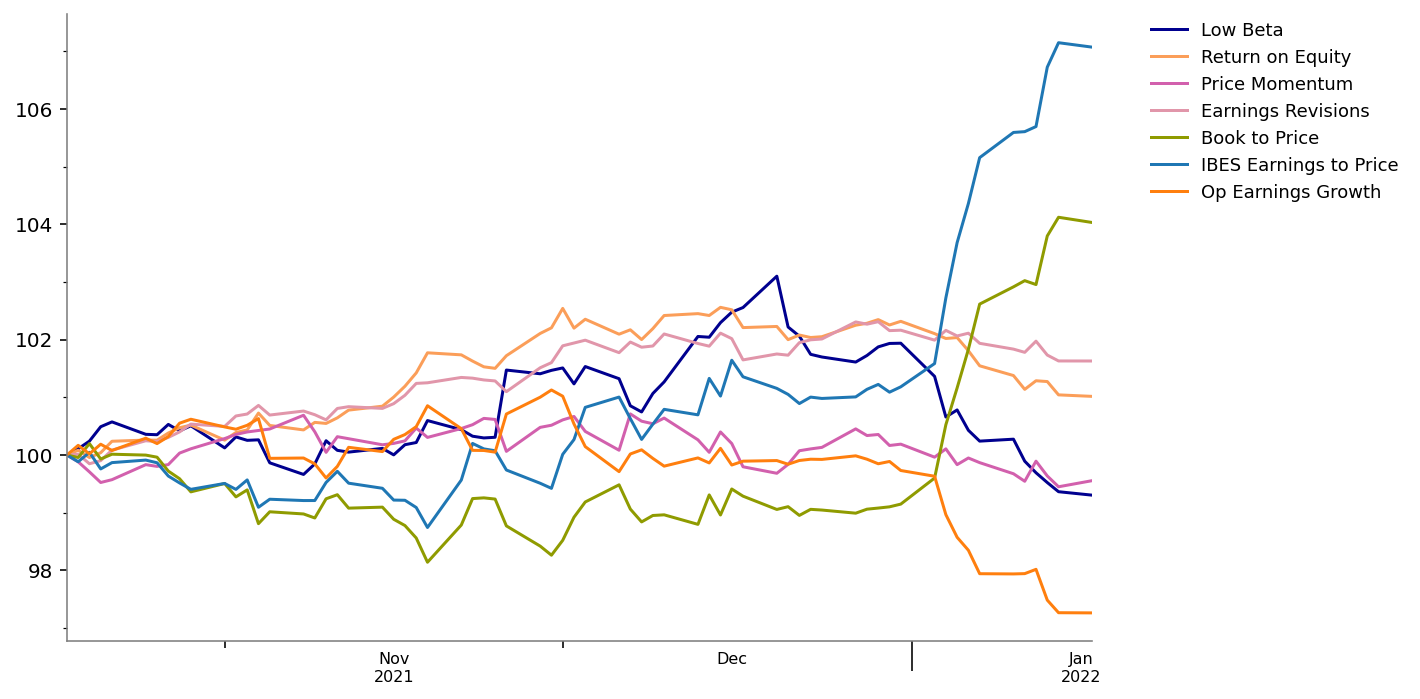

Global factor performance: Last three months

Rising bonds yields and shifting sentiment regarding the pace of fiscal tightening has driven significant factor performance dispersion in early 2022. Value delivered strong performance during January, a rally that has been consistent with the rise in US 10-year bond yields.

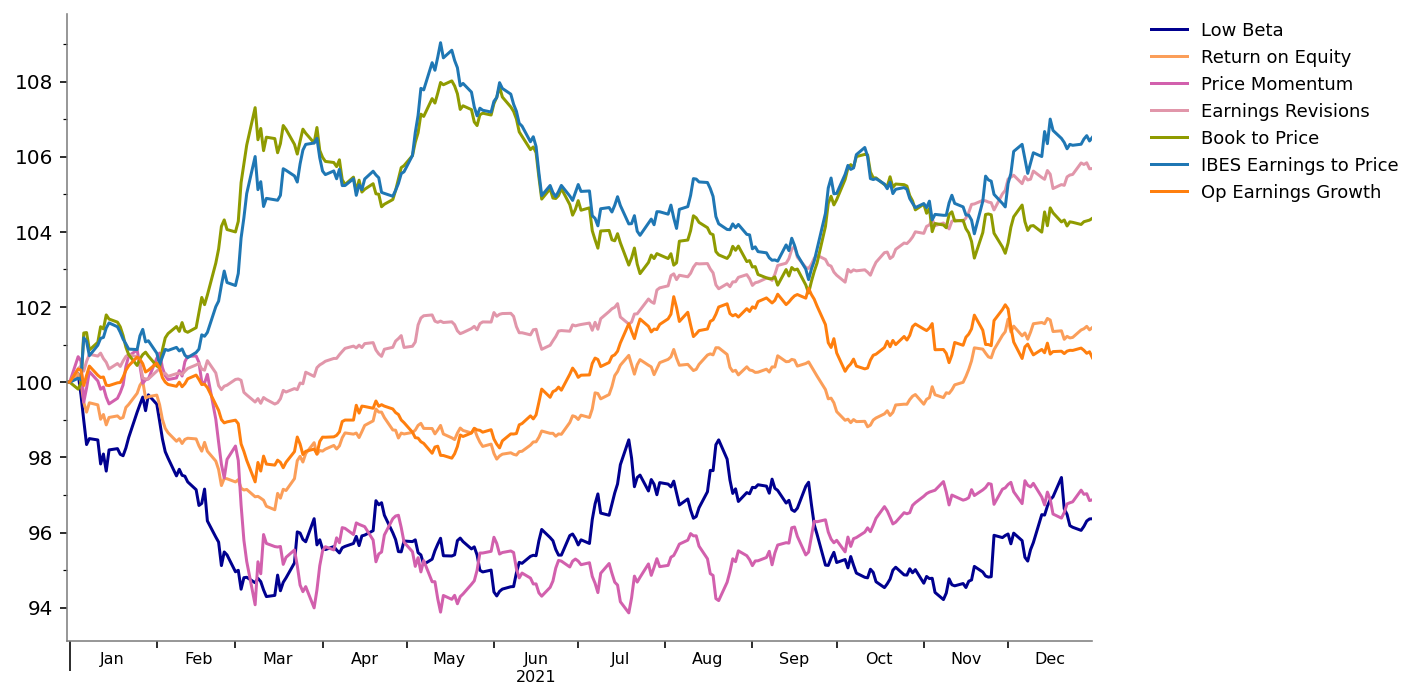

Global factor performance in 2021

Value and earnings revisions performed well during 2021. Quality (ROE) provided solid returns in strong up-markets especially during H2 2021.

Source for both charts: AXA IM. Factor returns data presented as of January 18th, 2021. The chart plots univariate factor returns calculated by AXA IM Equities based on MSCI World investment universe. The data are shown for illustrative purposes only and are not based on actual portfolio returns. Past performance is not a guide to future performance.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)