Why clean energy is a hot topic

“Blistering heatwave plays havoc with Europe’s strained energy system

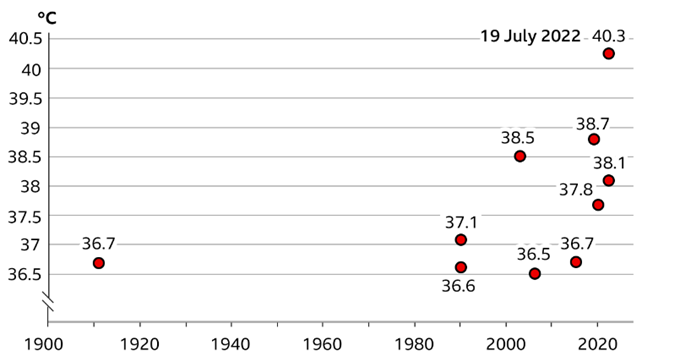

Top 10 hottest UK days on record

Source: BBC, Met Office, July 2022

Climate change is causing more extreme weather due to higher (and rising) average temperatures, longer and worse droughts, and more extreme rainfall events.

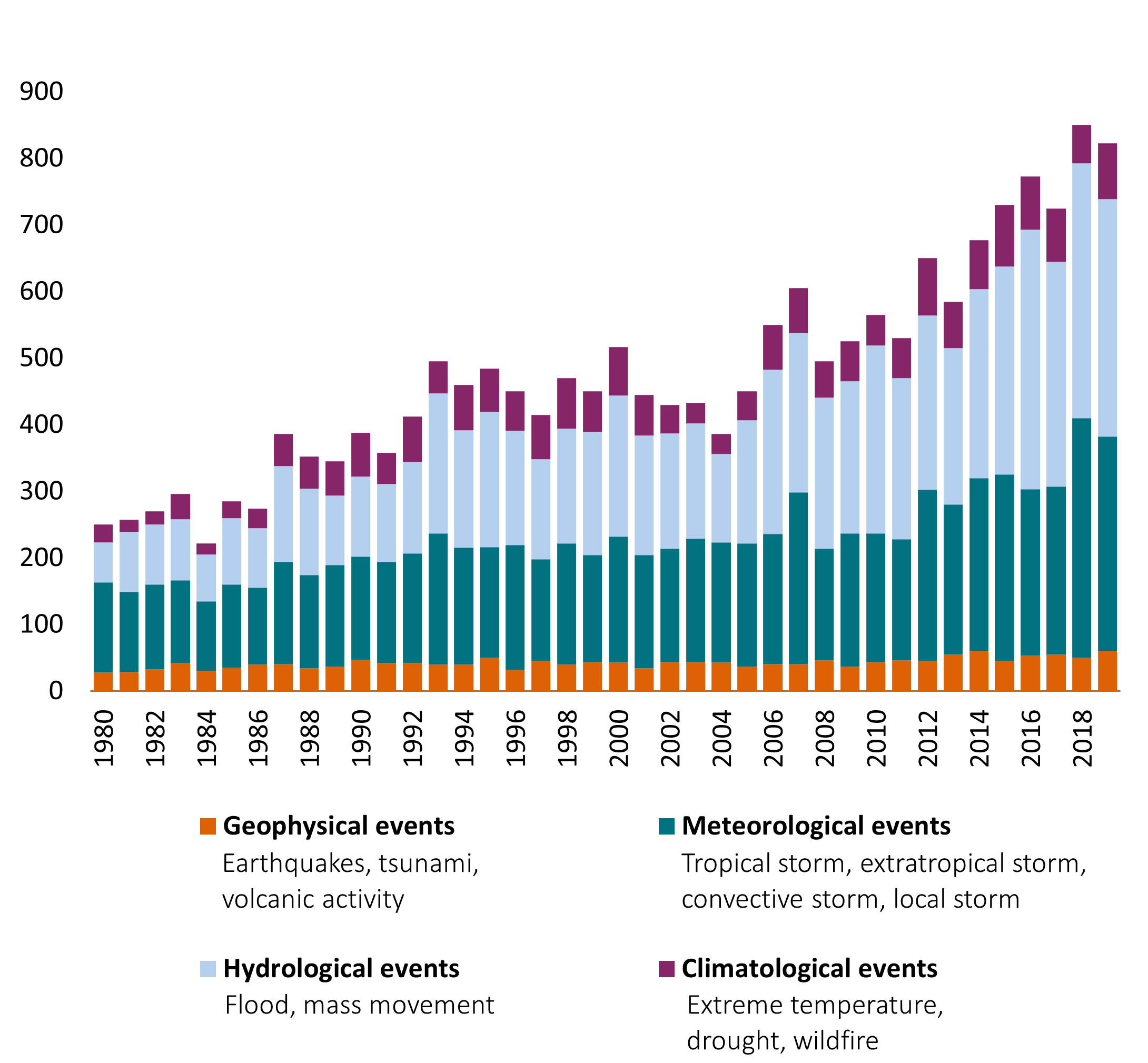

Having clarified the role played by carbon emissions in causing climate change, the incidence of extreme weather events emphasises the ongoing importance of growing investment in clean energy. Interestingly, the Financial Times article cited earlier also highlights how heat from extreme weather leads to higher electricity demand (mainly due to additional demand for air conditioning), tighter nuclear and hydro supply due to river water (used for cooling nuclear power stations) becoming too warm, and droughts leading to insufficient water volumes for optimal hydro generation respectively. This unfortunate situation has affected countries such as France and Switzerland who are likely to resort to additional, and more polluting, coal and gas generation to meet demand. This highlights an unfortunate negative feedback loop in action. The below graph shows how events causing loss are becoming more frequent:

Source: Munich RE, Met Office, July 2022

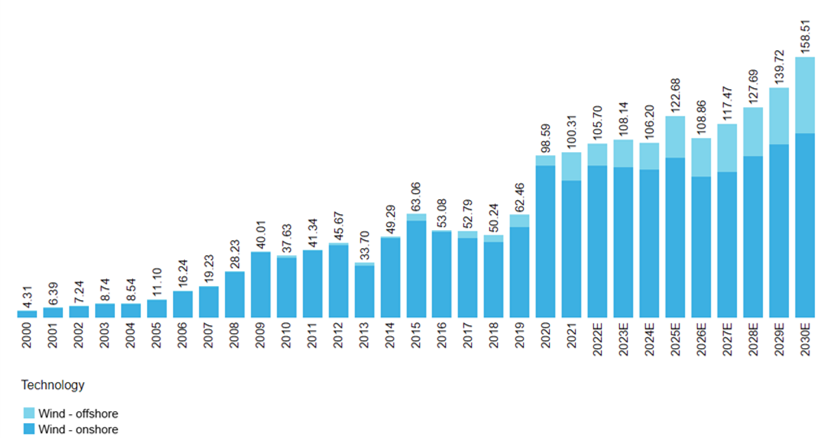

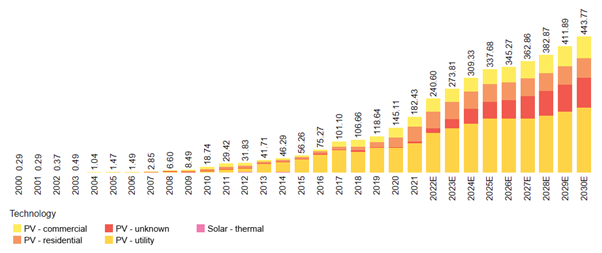

Over the medium and long term, we consider this bullish for clean energy growth – i.e. wind, solar and batteries. We think this thematic tailwind should drive structural growth for the wider sector, while acknowledging shorter duration cyclicality, such as the recently elevated logistics and material cost profiles. Bloomberg New Energy Finance, who forecasting renewables growth, continues to forecast strong growth in clean energy. The charts below show forecasted growth in wind and solar additions. Annual wind installations should rise ~50% from 2022-30 and solar ~85%.

Wind annual new additions (GW)

Solar annual new additions (GW)

Source: Bloomberg New Energy Finance, July 2022

We think growth in both technologies will be driven by their already compelling economics (i.e. offering cheaper all in generation costs versus fossil fuel alternatives), continued improvements in efficiency and technology, and likely ongoing policy support from governments. Against this backdrop, we believe we have better-than-average chances of finding strong-performing stocks in the wind and solar sectors.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)

__________________________________________________________________________

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.