Why duration is important

Why duration is important

Inflation-linked bonds are not floating rate notes but they are still sensitive to interest rate fluctuations. This is because they have duration. Duration plays an important role when it comes to inflation-linked bonds, so investors should be aware of how it works and the impact it can have.

For inflation-linked bonds, the higher the duration, the more sensitive the bond is to real interest rate changes. This is important for investors to be aware of as they may want to consider different duration strategies depending on interest rate movement expectations.

Remember: all inflation linked bonds from a given issuer are indexed to the same inflation rate, regardless their maturity.

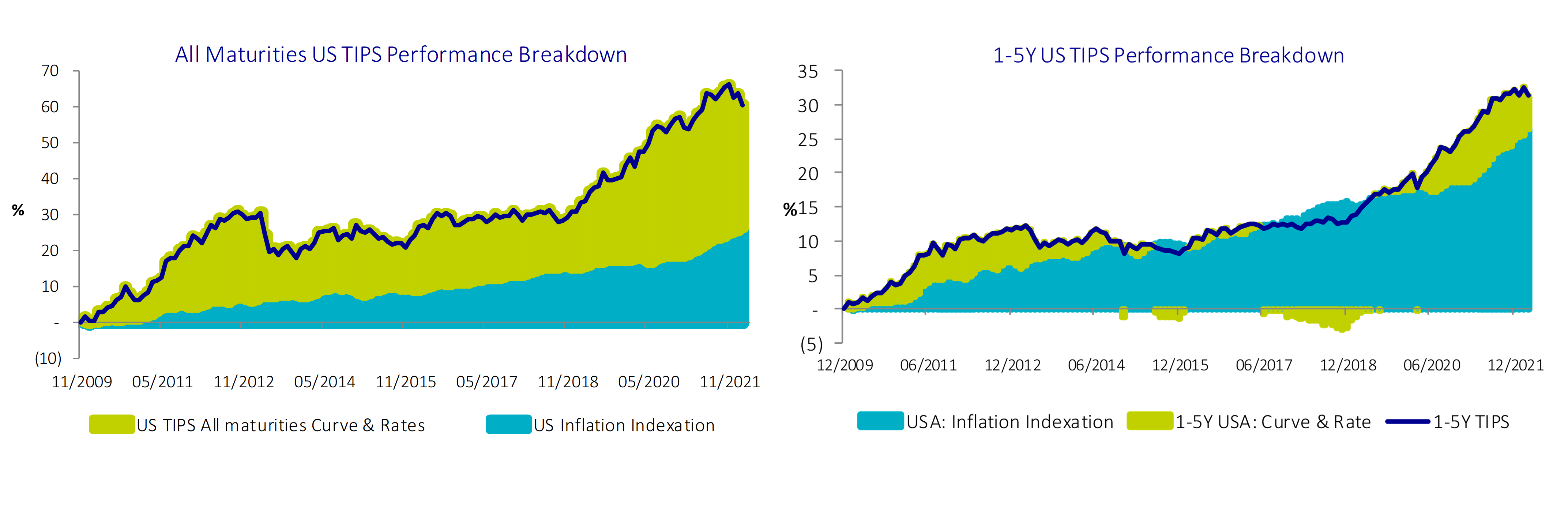

Short maturities inflation linked bonds have grown in popularity recently as investors that are willing to capture inflation indexation without getting excessive duration exposure

Source: AXA IM, Datastream – as at 31 May 2022 for illustrative purpose only and subject to change

In these two charts, the inflation indexation is the same for all maturities and short duration however, what differs is the impact of bond yields moving up & down.

In conclusion, short duration inflation-linked bonds are most sensitive to inflation itself and when the overall maturity of an inflation-linked bond portfolio is extended, the risk changes from being sensitive to oil and inflation into a more “bond-like” instrument.

Inflation

Inflation can erode the real returns of investments however tools like inflation-linked bonds could help investors mitigate the effects of inflation on their portfolio.

Find out more

Watch the other modules from our inflation series

The objective of this series is to make inflation-linked bonds investing simple to investors.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)

__________________________________________________________________________

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.