European equities offer potential long-term growth and value

KEY POINTS

European stocks have enjoyed significant outperformance in 2025, with the regions indices comfortably outpacing other major markets.

Year to date, the Euro Stoxx 600 index returned 25% in US dollar terms, against 16% for the MSCI World and 13% and 16% for the S&P 500 and Nasdaq indices respectively.1

European stocks have of course been cheaper than US equities. But while the valuation gap has narrowed from its more extreme levels, given the current backdrop of improving macroeconomic conditions and solid long-term policy commitments, we believe the asset class can continue to offer value relative to the US market, which has reached multiple new highs this year.

- Source: FactSet, data as of 25 September 2025

Policy support powering growth

European Union (EU) and national policies are central to fuelling further economic growth and bolstering greater investment opportunities across the region, especially in areas such as defence, telecommunications and energy.

For example, the EU’s Readiness 2030 plan – formerly labelled ReArm Europe – aims to increase Europe’s defence capabilities on the back of the ongoing Ukraine conflict and to address decades of underinvestment in the sector. The project includes more than €800bn in defence spending, as well as a €150bn loan facility for procurement and plans to mobilise private capital to support defence investment.2

Additionally, Germany announced a €500bn infrastructure and defence spending plan to shore up its defences and boost its economy, through financing projects in transport, energy, research and digitalisation - further helping to underpin the Europe’s defence sector for the long term.

Elsewhere the European Commission (EC) has pledged to mobilise at least €1trn in sustainable investments to support the 2019 European Green Deal, in a bid to make the continent climate neutral by 2050, which is helping to create an array of potential investments across renewable energy, technology, agriculture and transport.

Alongside this the proposed Savings and Investments Union – an EC initiative to better integrate Europe’s capital markets – is aiming to create an ecosystem that will boost competitiveness and strengthen the continent’s ability to address important issues like climate change.

- {https://www.europarl.europa.eu/RegData/etudes/BRIE/2025/769566/EPRS_BRI(2025)769566_EN.pdf;ReArm Europe Plan/Readiness 2030}

Infrastructure spending boost

Europe is also overhauling its utility network and grid systems to meet increased power demand; some 40% of Europe’s grids are over 40 years old, with €584bn of investment needed this decade, according to the European Commission.3 The EU Grid Action Plan aims to double the continent’s cross-border transmission infrastructure by 20303, improving supply chains and helping meet greater electricity demand, which should in turn create potential opportunities for equity investors in infrastructure and the energy sector.

Similarly, telecommunications companies have been investing in connectivity, as part of the EU’s Digital Decade programme.4 We are also seeing further consolidation within the European telecoms market, with mergers and acquisitions bringing the potential for larger, stronger players. Cable manufacturer Prysmian, for example, recently bought a US fibre company which it said would make it a leading provider of end-to-end fibre to the home solutions.5

- {https://ec.europa.eu/commission/presscorner/api/files/attachment/876888/Factsheet_EU Action Plan for Grids.pdf;Factsheet EU Action Plan for Grids}

- {https://ec.europa.eu/commission/presscorner/api/files/attachment/876888/Factsheet_EU Action Plan for Grids.pdf;Factsheet EU Action Plan for Grids}

- {https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/europe-fit-digital-age/europes-digital-decade-digital-targets-2030_en;Europe’s digital decade: 2030 targets | European Commission}

- {https://www.prysmian.com/en/media/press-releases/prysmian-closes-the-acquisition-of-channell;PRYSMIAN CLOSES THE ACQUISITION OF CHANNELL}

Gaining traction

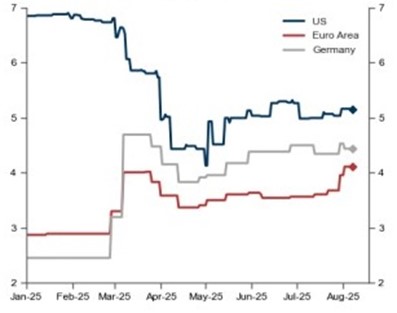

Year to date, the best performing sector among European equities is banking – and in August, European bank shares hit their highest levels since the 2008 global financial crisis, as long-term interest rates helped drive up banks’ profits.6

Among other sectors, French tyre manufacturer Michelin’s shares have been trading below the long-term average despite decent earnings growth. Cars will need new tyres no matter the broader economic backdrop, and Michelin is an industry leader, benefiting from its scale and premium brand.

Elsewhere, shares in Publicis, the world’s largest advertising company by revenue, have been trading below their long-term average, despite the media group recently upgrading its full-year growth expectations due to new business wins.7 We believe the company’s data platforms and artificial intelligence tools will continue to drive growth.

A positive economic backdrop

The broader macroeconomic backdrop is also improving; the Eurozone grew by 0.1% in the second quarter (Q2), a slowdown from Q1’s 0.6% expansion but better than the flat outcome the market had been expecting.8 What’s more, sentiment is improving, with market forecasts for GDP growth rising.

- {https://www.ft.com/content/c75ed243-d9d5-4013-b9b1-6e01617ce70d;European bank shares hit highest levels since 2008}

- {https://www.publicisgroupe.com/en/news/press-releases/publicis-groupe-first-half-2025-results;Publicis Groupe: First Half 2025 Results}

- {https://ec.europa.eu/eurostat/en/web/products-euro-indicators/w/2-14082025-ap;GDP and employment both up by 0.1% in the euro area}

Sentiment on Europe is improving

Cumulative real GDP growth forecast (y axis shows percent). Source: EPFR, Haver Analytics, Goldman Sachs Global Investment Research

Inflation across the bloc has remained comfortably at, or near to, the European Central Bank’s 2% target in recent months. This compares to 2.7% inflation in the US – where price pressures are expected to increase because of the US administration’s tariffs.

The full impact of the tariffs remains to be seen, but the trade agreement that Europe reached with the US in July gave both companies and investors some much-needed clarity. Prior to that, many companies shelved investment decisions which had ramifications for European economic growth. European exporters will nonetheless need to navigate higher tariffs than before.

Despite some headwinds from tariffs, geopolitical uncertainty and sluggish economic growth, we believe there is still considerable value to be found in European equities. With attractive valuations and the prospect for improved growth and consolidation, alongside German and EU-wide fiscal stimulus, there are plenty of reasons for optimism, with a broad – and growing range of potential investment opportunities.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)

__________________________________________________________________________

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.