Five reasons why Europe is back on the investment map

KEY POINTS

1.Attractive valuations

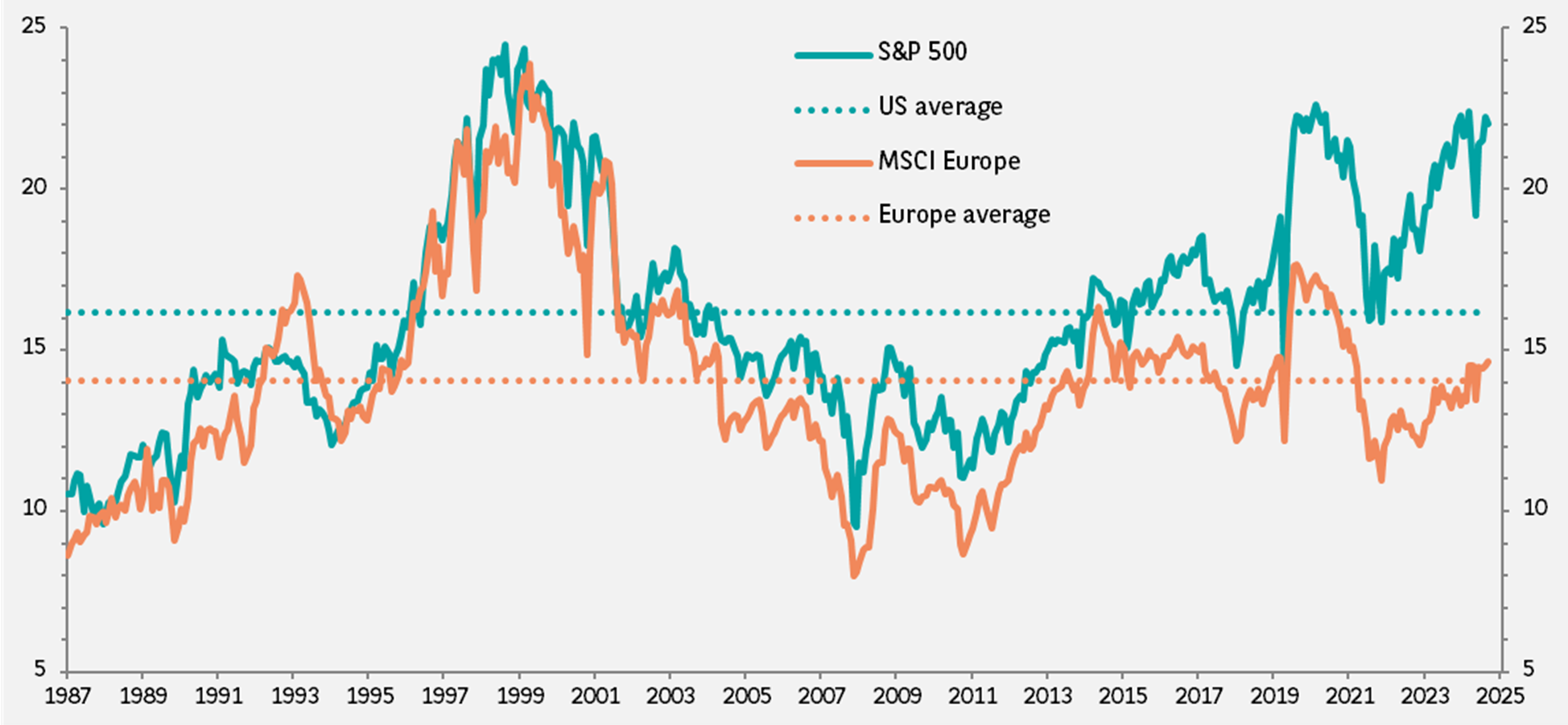

Attractive valuations are a powerful argument in favour of European equities, which currently trade at significant valuation discounts compared to the US.

The next-12-month price-earnings ratio for the MSCI Europe index is currently 14.6 times, slightly above the average since 1987 of 14 times. By contrast, in the US valuations are close to all-time highs, currently 22 times expected earnings.

Europe's average dividend yield is near 3.3% substantially exceeding the US average of about 1.3%.

Exhibit 1: Valuations far lower for European Equities

Next-twelve-month price-earning ratio

Data as at 26 August 2025. Sources: IBES, FactSet, BNP Paribas Asset Management

2.Recovery in earnings looking bright

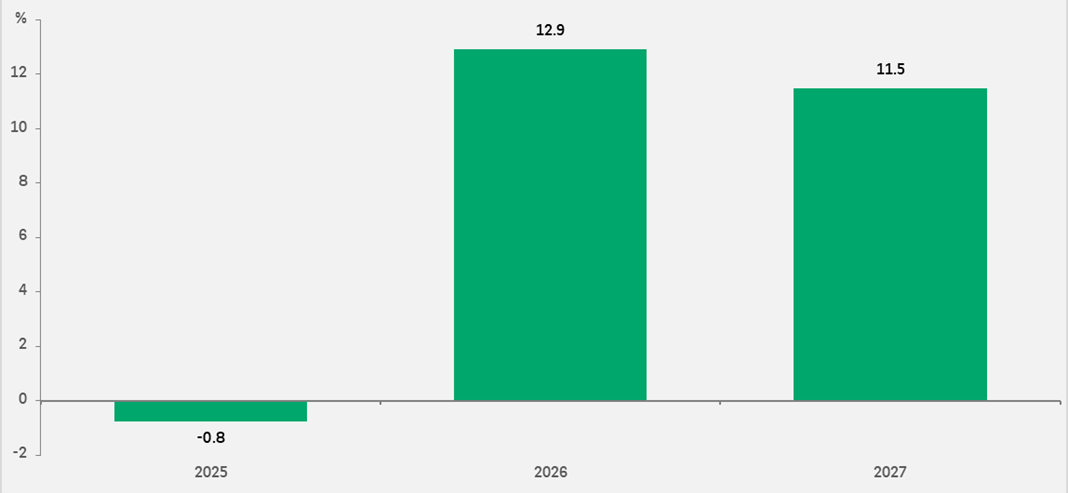

Europe’s equity earnings outlook is brighter than it has been in many years. Consensus estimates for profit gains over the next couple of years see a big improvement on results compared to 2025, as Exhibit 2 shows.

The expected gains are particularly high in industries such as biotechnology, at 34% 2027/2026 earnings-per-share (EPS) growth, semiconductors (24%), and aerospace and defence (17%).

Exhibit 2: Earnings growth is expected to rebound sharply over the next couple of years

Year-on-year EPS growth

Data as at 26 August 2025. Sources: FactSet, BNP Paribas Asset Management

3.Unprecedented increase in Europe’s defence and infrastructure spending

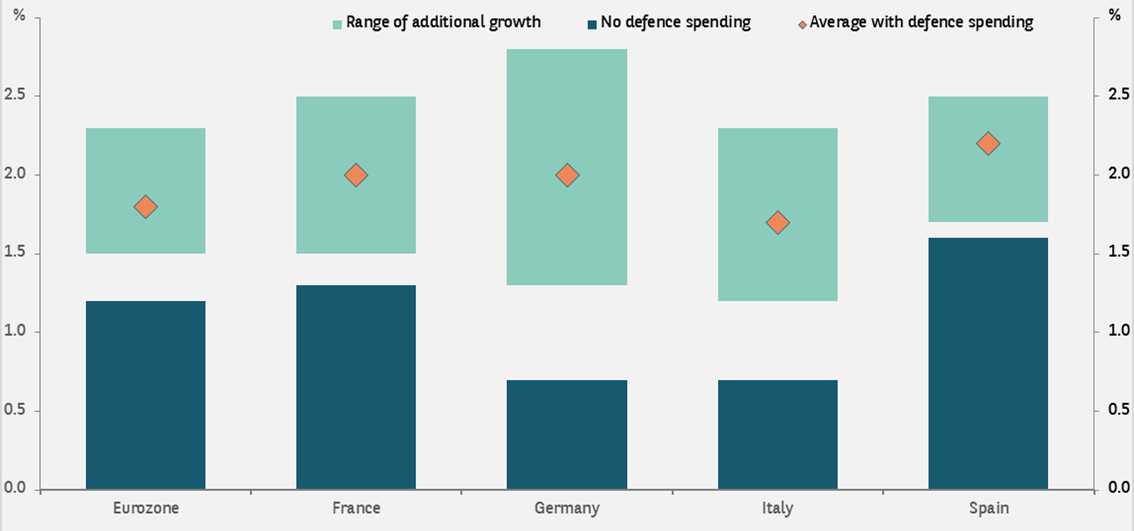

US President Donald Trump’s push for greater defence burden sharing has borne fruit. There is broad acceptance across NATO countries to spend 5% of GDP on defence (broadly defined). We estimate the increase in defence spending could double the rate of real GDP growth across the region.

In addition, Germany has launched a major infrastructure and defence initiative, with investments of €500bn over the next 12 years in sectors including infrastructure, construction, renewable energy, healthcare and defence. This is a huge change for Germany and for Europe, which has historically been reluctant to spend to boost growth. This spending should have a meaningful impact on the continent’s growth rate as there is significant spare capacity in the economy.

Exhibit 3: GDP should increase across Europe

Real GDP growth

Data as at 26 August 2025. Sources: BNP Paribas Asset Management.

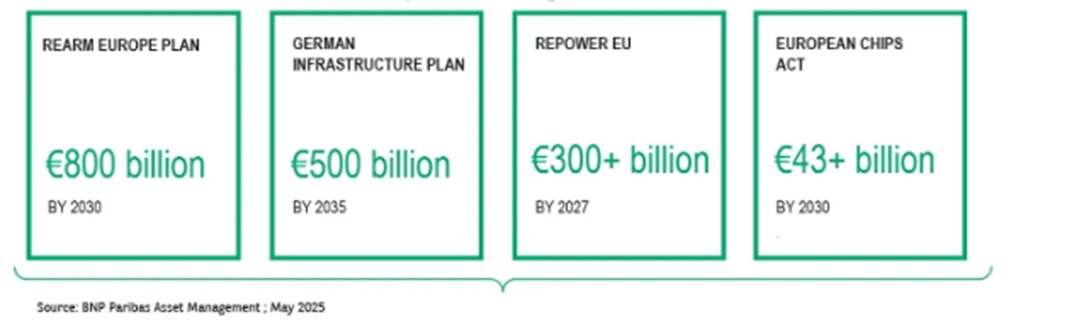

Europe’s pursuit for strategic autonomy has emerged as a central priority. For the region to act independently in key areas such as defence, energy, digital infrastructure and critical supply chains, investment plans for key public initiatives of a historic scale are in the pipeline.

The planned investments in Europe’s strategic autonomy amount to over €1.6trn

4.European fixed income offers opportunities

A crucial argument in favour of European fixed income is the confidence in the European Central Bank (ECB) to remain vigilant about inflation risk. Bondholders can rely on the ECB to protect them from inflationary pressures.

European fixed income, and in particular corporate debt continues to perform well with a relatively low level of volatility. In the first half of 2025 it has once again shown resilience in the face of considerable uncertainty.

European economic growth has been resilient in the first half of 2025. There is scope for a further pick-up in corporate investments and M&A activities as the Eurozone economy gains momentum in over the next 12 months. Companies in the corporate debt universe continue to prioritise deleveraging. Inflows into mutual funds and demand for collateral for Collateralized Loan Obligations are bolstering demand.

Our analysis shows fundamental characteristics of companies in the euro high-yield sector as relatively solid. Corporate results for the region continue to demonstrate the resilience of business models. Profit margins are stable, costs are well under control and there is potential for cash generation and balance sheet improvement. While there is limited scope for further significant spread tightening in 2025, we expect carry and security selection to drive performance.

5.Capital meets opportunity for private assets

In addition, private capital is positioned to help reshape the European continent’s global competitiveness by driving innovation, creating European champions, and mobilising the sizeable investments required. We believe Europe is emerging as one of the most compelling destinations for private asset investments.

The case for Europe factors in a gap in market valuation between European companies and their US-listed peers and falling financing costs. But it is primarily based on a growing conviction that economic reforms, combined with a stable environment for long-term investments, pave the way for major opportunities across Europe for all investors.

Europe offers macroeconomic and policy stability - combined with a highly investable structural roadmap. Public plans are creating tangible project pipelines and co-investment frameworks - not just wish-lists. Private capital is explicitly sought after to complement and scale up public capital across asset classes. Deployment is aligned with long-term objectives: impact, resilience, energy security, and re-industrialisation.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)

__________________________________________________________________________

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.