Code, build and repeat

Stock market returns of more than 20% are common around the world this year. In the US, the S&P 500 remains on track to make it a third consecutive year of returns above 20%, with potentially more than $10trn added to its market capitalisation. That’s a lot of new wealth, on paper. There is a lot of new investment taking place because of the artificial intelligence (AI) boom as well. In addition, lower interest rates complete the triple drivers of US growth. It’s not balanced but it’s not slowing down either.

- Key macro themes – The AI boom becomes ever more dominant

- Key market themes – US corporate earnings growth is very strong

Refined drivers

A few weeks ago I wrote about three key drivers of US economic growth – the wealth effect, favourable credit conditions, and a generally supportive fiscal policy stance. I would nuance that a little now. The AI boom deserves to stand alone - this is a huge driver of the wealth effect, while the balance of economic policy is supportive. The latter reflects supportive monetary and fiscal policy, against what I would term as “America First” policies that reflect the polemic of the current Administration. This week the AI acceleration, supportive monetary policy and the wealth effect were all in focus.

Boom time

The message from US technology companies that reported third quarter (Q3) earnings this week is that the AI investment spurt shows no signs of weakening. More than one of the hyperscalers suggested that capex spending would rise further to ensure capacity kept pace with the increased demand for AI products. There were some signs that investors were a little spooked by the realisation that more and more money will be spent in the quarters ahead, even though earnings, overall, came in above expectations. The big question remains will future profits justify the huge amounts being spent today? The differences in share price reactions to earnings announcements highlighted how investor sentiment is very tuned to the balance between the need to invest and the realisation of future earnings.

Invest to disrupt

The capital spending numbers are huge. The eight biggest stocks in the S&P 500 are spending amounts equivalent to almost 10% of the total private fixed investment spending recorded in the national accounts data. I’m not strictly comparing like with like here, but nearly one in 10 investment dollars is being spent by the big technology companies (some of which will be outside the US of course). Meta reported $18bn on capex in Q3; Microsoft more than $19bn; and Google’s parent Alphabet almost $24bn. It’s hard not to underestimate the impact this spending is having through supply chains and on the broader economy. The message was clear though; the capex is necessary to raise capacity to meet demand for AI through existing and new products. Spending on data centres, computing hardware, energy sources and so on is a huge positive for overall economic growth. The euphoria was intensified when Bloomberg reported that OpenAI was planning an initial public offering with a target valuation of $1trn. Some way to go to catch Nvidia ($5trn) but not bad for a start-up!

Cash burn and borrowing

These companies have a lot of cash to spend. According to Bloomberg, the combined cash and cash equivalent reserves of the top eight companies was around $500bn at the end of Q3. When you are generating the kind of revenues that these guys do it’s no surprise that cash piles build up. They generally don’t have that much debt either compared to total assets and revenues. But that may be starting to change. Meta announced on Thursday that it was borrowing $30bn in the US corporate bond market across six different maturity tranches. The AI arms race is meaning more capex, which needs funding. The book for the bond issue was, apparently, more than $125bn. Bond investors are keen to benefit, in the form of coupon payments, from the anticipated revenues that will accrue based on all that capex taking place. Here’s a thought – is the 5.75% coupon, 2065 maturity a better bet now than Meta stock which pays a 0.3% dividend yield (which has grown at 38%)?

Getting richer

Even though there was a mixed share price reaction to some of the technology company announcements, October has been another good month for the index, which is on track for a 2% total return. In four out of the last five years, November has delivered more than 5% total returns. The market capitalisation of the top 10 stocks in the index has risen by more than $5trn in 2025. That is great for US savings in retirement schemes and brokerage accounts. But of course, the gains are not evenly spread, and Americans are not obviously gung-ho. The Conference Board research organisation reported that its consumer confidence measure fell slightly in October, with the expectations index at 71.5 compared to 91.9 a year ago. For those earning over $125,000 per year though, the confidence index moved decisively higher in October while it fell for those households with incomes below $50,000.

Pause on rates and yields?

On the policy side, the Federal Reserve (Fed) met market expectations and cut rates by 25 basis points (bp) to a range of 3.75% - 4.0%, the lowest level for the Fed Funds Rate in three years. The Fed is operating without sight of official data, leading to increased uncertainty over forthcoming policy steps. There were two dissents at the vote: one to keep rates unchanged and one to cut by 50bp. Fed Chair Jerome Powell himself said that a December cut (which was priced in by markets) was not a foregone conclusion. As a result, bond prices have moved a little lower this week with the 10-year Treasury yield backing up to 4.1%. While the default market expectation has been that of a terminal rate of 3%, to be reached in late 2026, uncertainty about the path of policy rates should mean a higher term premium in the yield curve.

The AI story could also provide upside risks to bond yields. In the long run there could be some disinflationary impact from AI, given its potential to improve competitiveness and disrupt labour markets. But if AI investment is demanding more capital and creating increased demand along the supply chain, there could be an opposite effect. Bonds have had a good run since May; some stabilisation might be necessary now given the lack of data anchors for macro-trading and given Powell’s comments regarding the December rate decision.

Scary monster (and super freaks)

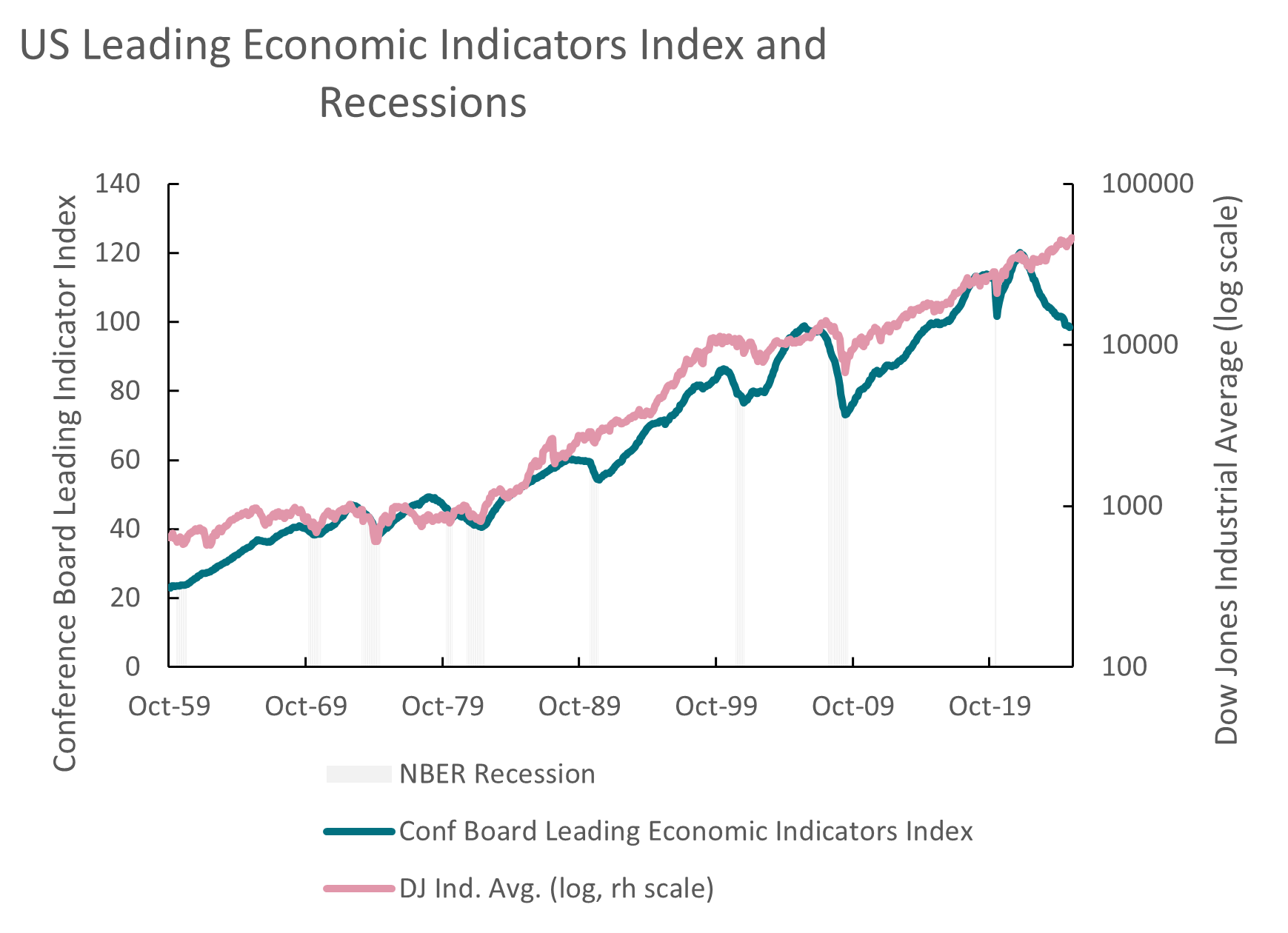

Halloween is here. If you want to get spooked, contemplate the chart below. I was inspired seeing a version of this on LinkedIn this week. It plots the US Conference Board’s Index of Leading Economic Indicators against periods of recession and the Dow Jones Industrial Average. The leading indicators index has been published since 1959 and its components include the Treasury yield curve slope, data on manufacturing new orders, jobless claims and credit growth. AI may be changing the rules, but one interpretation of this chart suggests we are in for a recession and a stock market correction. To paraphrase the witches’ chant from Shakespeare’s Macbeth – “double, double toil and trouble. Artificial intelligence and a stock market bubble”.

Source: Refinitiv Datastream – 30 October, 2025

Back

I wouldn’t just return to commenting on football just because Manchester United have won three games in a row and Liverpool has lost six out of seven games, would I? At any rate, I feel a whole lot better about my team than I have for some time. Nothing can be taken for granted in football, but at least a chance of finishing in a Champions League qualifying position this year looks more realistic. The team is getting a bit of swagger back and with a new goalkeeper and more dynamic front players, it is looking good. As for my other team, Sheffield Wednesday, the story could not be more different. The club went into administration on 24 October and is now looking for new ownership. Now, where has all the money been made in the world this year? Anyone in Silicon Valley fancy a second (soon to be third) tier English “soccer” team?

Performance data/data sources: LSEG Workspace DataStream, ICE Data Services, Bloomberg, AXA IM, as of 30 October 2025, unless otherwise stated). Past performance should not be seen as a guide to future returns.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)

__________________________________________________________________________

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.