ECB strategy review: The investment implications

KEY POINTS

A cursory glance at the European Central Bank’s (ECB) 2025 monetary policy strategy assessment shows no major changes to its last review four years earlier – something which should, in the main, comfort investors. However, a deeper dive into the document and the surrounding macroeconomic backdrop reveals it to be - in our view at least - an ECB strategy policy overhaul, rather than a technical fine-tuning exercise.

At a surface level, much remains the same; for example, the ECB has reaffirmed its 2% inflation target, which in 2021 was seen as a major monetary policy innovation, following its previous policy of "below, but close to 2%”.

But in the intervening years, the macroeconomic environment has changed significantly, not only in terms of the global geopolitical set-up, but also in its fundamental structure.

The sequence of shocks that Europe - and the wider world - have endured in the aftermath of the pandemic has likely dealt a blow to the mainstream demand-centric framework, and therefore pulled many policymakers significantly out of their comfort zone. As such, while not much in the strategy review’s text has changed since 2021’s edition, there have been significant changes to the macro backdrop.

A new macro backdrop

Let’s put this into context by reflecting on the following: Eurozone inflation averaged 1.4% in the 2010-2020 period, and since then, it has averaged 3.7% - peaking at 10.6% in October 2022. In July 2022, the ECB lifted its main benchmark interest rate - the Deposit Facility Rate - out of negative territory, from -0.5% to 0%, while inflation was running at a very steep 8.8%. Tellingly that decision trailed the US Federal Reserve by four months, during what was a period of very intense debate between those ECB Governing Council members who dismissed inflation as “transitory” and those who were already looking at the economy through a new and different lens.

And very significantly, prices have increased by 22.8% during Christine Lagarde’s ECB presidency - which commenced in 2019 - twice as fast as the pace at which the ECB has defined price stability. The negative effect on spending power is obvious. Encouragingly, inflation has returned to close to the ECB’s target by mid-2025.

The 2025 strategy review concentrates on five complexly intertwined macro areas in the art of monetary policy making:

- Inflation target: Confirmation of a symmetric 2% objective, i.e. inflation deviation in both directions will be addressed

- Uncertainty: Structural shifts in the global economy are a direct result of macroeconomic trends like demographics, technological innovation (e.g. artificial intelligence), climate change and so on. For policymakers, this means there is the potential for significantly larger forecasting errors and inflation uncertainty

- Policy tools: All monetary policy instruments are available. Selection, design and implementation will be adapted as the economy is hit by shocks of a different nature

- Integrated approach: The decision-making process is based on economic, monetary and financial information. Non-linearities shall be addressed and accounted for, when formulating a policy trajectory. This is an evolution of the previous ‘two-pillar’ approach i.e. economic analysis and monetary analysis

- Communication: Scenario and sensitivity analyses – reflecting the increased forecasting uncertainty – are made public, thus supporting and reinforcing the President’s policy statement and Q&A. This is an evolution of the previous ‘baseline communication’ approach.

The investor takeaway

Ultimately, for investors the 2025 strategy review implies a continuation of the market-friendly philosophy championed under former ECB President Mario Draghi. Despite the perils of using non-standard instruments like quantitative easing, a point raised time and again by Executive Board Member Isabel Schnabel and recently stressed by the Bundesbank, all such extraordinary instruments and measures remain on the policy menu.

This is also very important from the point of view of monetary policy transmission, which may suffer from substantial side-effects in the neighbourhood of the so-called reversal rate - the level of interest rates below which monetary stimulus becomes counterproductive - and therefore potentially reduces policymakers’ credibility. This can also significantly matter for European government bond markets’ stability, especially at a time of public balance sheet deterioration and gradually reflating term premiums.

Investors should therefore consider the trade-off between bond market consolidation and the relative value of government bonds, when including the 2025 policy review in their strategic asset allocation views.

- For instance, non-standard policy instruments are typically deployed by the ECB when facing risks to price stability, including the fragmentation of government bond markets. This is irrespective of instruments actually being implemented e.g. the Public Sector Purchase Programme (PSPP) or being only threatened like the Transmission Protection Instrument (TPI).

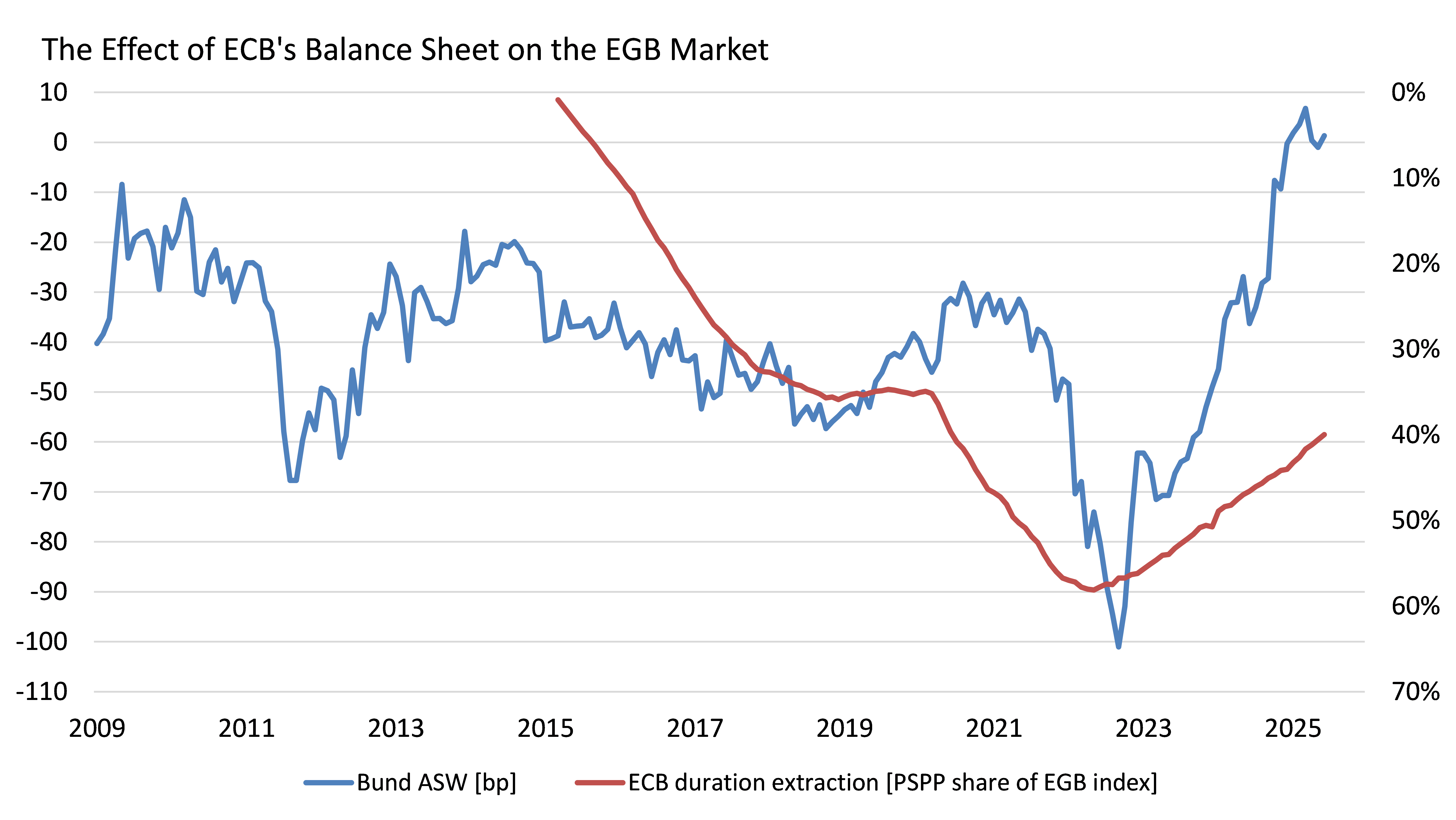

- And while non-standard instruments are helpful in containing the volatility of government bond spreads, disproportionate use of the central bank’s balance sheet might take its toll on key bond market parameters like liquidity, depth and scarcity. As a consequence, monetary policy action might at times influence price discovery to the extent of distorting relative government bond valuations. The relationship between the ECB’s PSPP and German Bund asset swap spreads (ASW) – the difference between a yield and the swap rate - is visualised in figure 1.

Figure 1

Source: AXA IM, Bloomberg, ECB

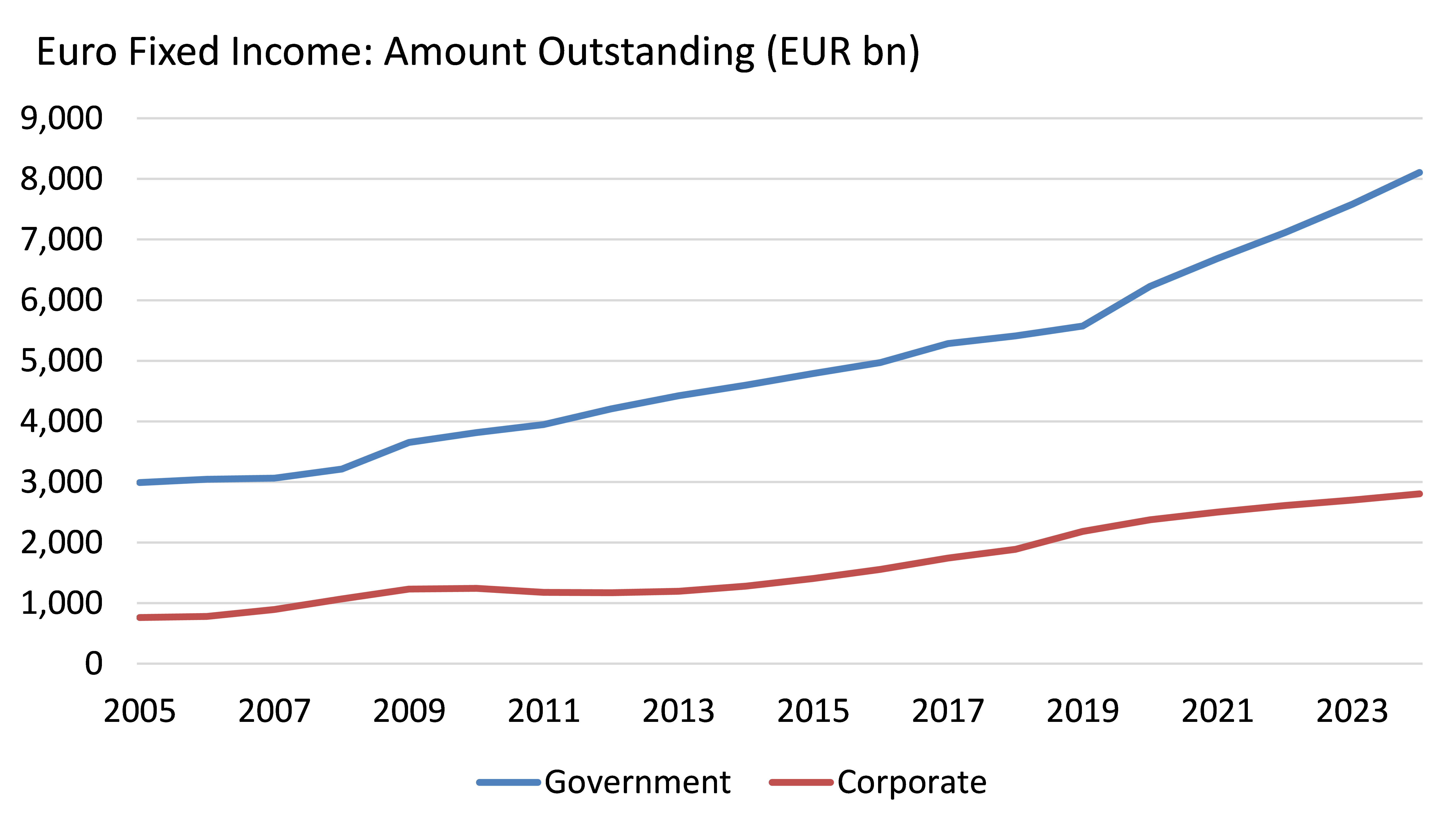

To complicate matters for central bankers, Eurozone fiscal policy, which is not always compliant with the European Commission’s Stability and Growth Pact’s stringent rules – designed to ensure EU nations pursue sound public finances and coordinate their fiscal policies - has boosted the government bond market’s size relative to corporate debt (figure 2). While not unique to the Eurozone, this trend is raising questions about the so-called risk-free interest rate as well as the shape of the yield curve.

A steady rise in debt-to-GDP ratios makes public finances increasingly sensitive to sustainability risks. A large positive term-premium is often associated with such an increase in public debt, while a subdued or even negative one is usually linked to the effects of large-scale asset purchase programmes and forward-guidance strategies.

Figure 2

Source: AXA IM, Bloomberg

In practice, the intersection of a market-friendly ECB and an expansionary fiscal stance, together with a macroeconomic backdrop of already high debt-to-GDP levels, should make corporate balance sheets more attractive than the public balance sheet.

Ultimately though, in times of economic stress, the public balance sheet has greater relative attraction - companies can default, but government bonds can be financed by the measures outlined.

Hence, the assumption of credit risk might be preferable to duration risk as a means of potentially boosting portfolio returns for the time being. As is often the case in finance, investors will be confronted with the essential question of price: as the yield curve steepens relative to credit spreads in risk-adjusted terms, duration’s attractiveness relative to credit spreads will increase. At some point, duration will once again become an interesting engine of alpha.

Eventually, adding several degrees of freedom to an already complex decision-making process comes at the risk of tilting the ECB’s monetary policy strategy away from a transparent and comprehensive rule-based model.

It will be the President’s task to convey Governing Council decisions in a manner which is satisfactory for all market participants, without giving the impression of being overly discretionary, while at the same time allowing for the macroeconomic environment’s increased uncertainty.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)

__________________________________________________________________________

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.