Take Two: Stocks enjoy strong start to 2026; Eurozone inflation returns to target

What do you need to know?

Global stocks enjoyed a strong start to 2026 with several markets already reaching new highs. The Dow Jones Industrial Average closed above 49,000 for the first time last week while the S&P 500 also hit a record high. Europe’s Stoxx 600 also closed at a new peak as did Japan’s Topix and Nikkei 225 indices. Additionally, the UK’s FTSE 100 crossed 10,000 points for the first time on its first trading day of the year. Continued optimism over artificial intelligence and expectations of lower interest rates helped drive the rally although concerns over geopolitical tensions slightly tempered its momentum.

Around the world

Eurozone annual inflation eased to 2% in December, returning to the European Central Bank’s (ECB) target for the first time since June and falling from November’s 2.1%. Core inflation – excluding energy, food, alcohol and tobacco – edged down to 2.3% from 2.4%, according to an official flash estimate. The ECB predicted in December that headline inflation will average 1.9% in 2026, down from 2.1% in 2025, and increased its economic growth forecast for the Eurozone to 1.2% this year from the 1% previously estimated. Elsewhere, China inflation rose 0.8% on an annual basis, its highest level in almost three years, driven partly by higher food prices.

Figure in focus: 52.7

US business activity rose at a slower pace in December as the services sector expanded at its lowest rate since April. The composite Purchasing Managers’ Index (PMI), which includes both manufacturing and services, fell to 52.7 from 54.2 the previous month – a reading above 50 indicates expansion. Meanwhile, Japan’s private sector output expanded at its softest pace in seven months in December, as the composite PMI fell to 51.1 from 52.0. Eurozone business activity also rose at a slower pace, with the composite PMI at 51.5, down from 52.8, but registered its strongest quarterly growth in over two years.

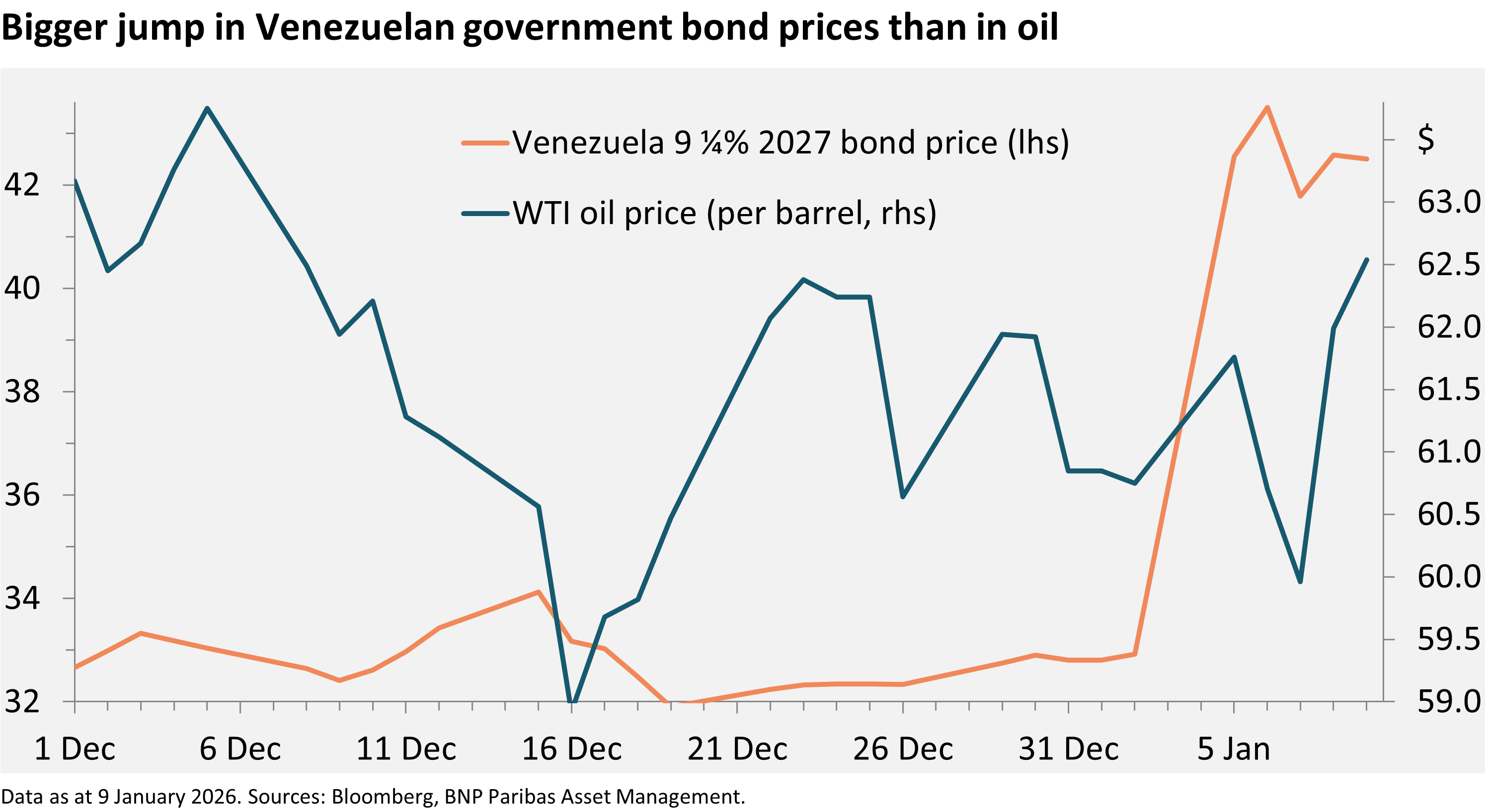

Chart of the week

Investors got a New Year surprise with the US arrest of Venezuelan president Nicolás Maduro. The market reaction to the news was largely positive. US oil majors’ share prices rose and Venezuelan government bonds jumped sharply. Oil prices have been volatile, with near-term supply disruption and geopolitical risks battling expectations for an increased supply that could eventually follow from US investment in the sector. While Venezuela has the world’s largest oil reserves, its production is relatively limited. Twenty years ago, production peaked at three million barrels per day; today it is under one million. A return to the previous level, which would not be swift, amounts to just a 2% increase in total global production.

Words of wisdom

Atlantification: The gradual warming of the Arctic Ocean due to warmer water from the Atlantic Ocean flowing in. A study conducted by the US-based National Oceanic and Atmospheric Administration (NOAA) has warned of the ‘Atlantification’ of the northernmost part of the planet, as it becomes warmer, saltier and increasingly ice-free. Atlantification is eroding sea ice, “reshaping ecosystems and threatening climate stability,” NOAA said. Surface air temperatures across the Arctic from October 2024 through September 2025 were the warmest recorded since 1900, it said, while the oldest and thickest Arctic sea ice has declined by more than 95% since the 1980s.

What’s coming up?

On Tuesday, the US reports December inflation data; in November, inflation rose less than anticipated to 2.7%. China updates markets on its trade balance on Wednesday. On Thursday, the UK reports monthly GDP data for November, while Germany announces its full-year GDP growth rate and Eurozone industrial production data is released. The US reports its own industrial production figures on Friday.

Read more insights at the Investment Institute

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)

__________________________________________________________________________

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.