US reaction: Core CPI strength leads to shift in rate outlook

- 10 April 2024 (3 min read)

March’s CPI inflation posted another surprise to the upside. The headline rate rose on the month by 0.4%, taking the annual rate up to 3.5% - its highest rate in six months. While food prices remained reasonably benign, rising by just 0.1% on the month, energy prices were firm with motor fuel prices rising by 1.6% on the month and household energy services up 0.7%.

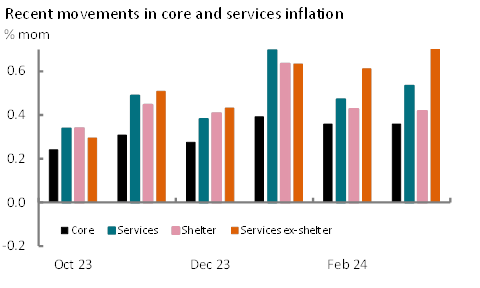

Yet it was developments in core prices that were the most troubling. Core inflation, excluding food & energy, also rose by 0.4% on the month, leaving the annual rate unchanged at 3.8%. The 0.359% rise was very much in line with February’s rise, but above market expectations for a 0.3% rise. While only marginally higher overall, it is services inflation that is causing the most concern (Exhibit 1). Services posted a 0.53% rise, faster than the 0.47% in February (albeit below the 0.7% January). Within that, shelter inflation was broadly unchanged, rising by 0.42% the same as the average pace for each of the last 9 months, barring January’s rogue reading. We still expect to see deceleration in this component over the coming months give the drop in housing costs seen across last year, but this is proving slower to materialize than expected.

However, services ex-shelter posted their fastest increase in 18-months, up 0.84% underpinning a steady acceleration in the 3-month annualized rate to 7.4%. While previous strength had been attributed to more volatile components including airfares, in March airfares fell by 0.4% on the month. Strength was rather recorded across a range of other indicators, including healthcare, where hospital services and health insurance both rose by 1.2%, transport services which rose by 1.5%, driven mainly by vehicle maintenance costs and motor insurance and miscellaneous services costs. In short there was a range of services costs that contributed to drive the monthly rate higher, something more suggestive of a tight labour market and elevated wages feeding through into broader pricing.

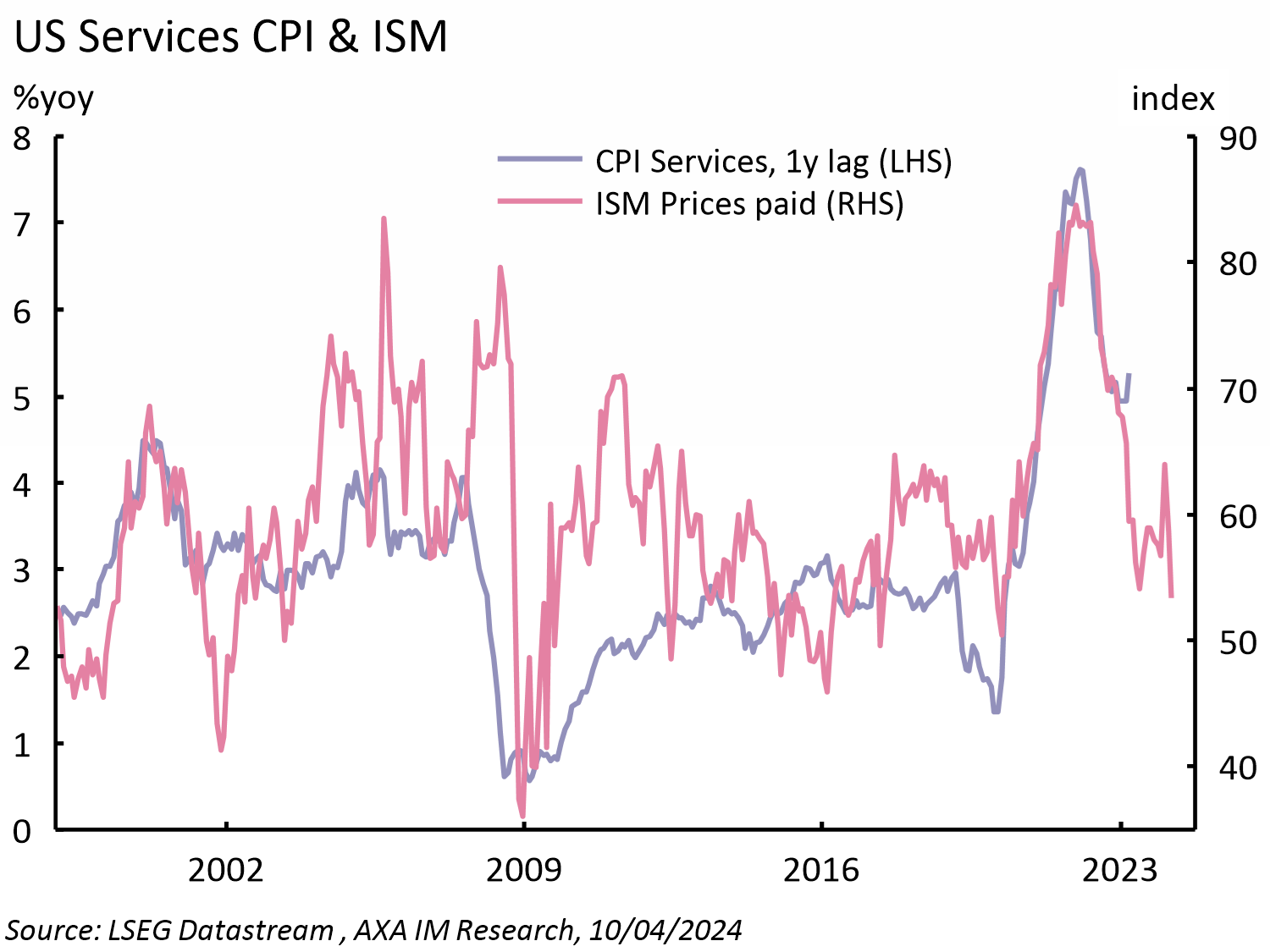

Medium-term indicators of services inflation still point to marked deceleration in services inflation ahead, including the prices paid component of the services ISM index which fell to its lowest level since the pandemic (Exhibit 2). However, this is not materializing yet. This is both a surprise to us and a challenge to the Federal Reserve’s outlook. While Fed Chair Powell was happy to dismiss January and February’s strength as bumps along the road, he reiterated that the Fed required further evidence to suggest that inflation was continuing to fall to target. Today’s figures have not delivered that and while we expect to see a softening in services ahead, the Fed is likely to require more than two softer report before it gains sufficient confidence. We have expected the Fed to begin to ease its restrictive stance in June since October, but now we push back our expectation for the first cut to July. We had also been expecting to see weaker growth see the Fed quicken the pace of rate cuts towards the end of this year. Although we still await Q1 GDP, we see firmer momentum for now and as such we remove this expectation. This leaves us expecting the Fed to cut rates to a range of 4.50-4.75% by year end and 3.75-4.00% by end 2025. However, we acknowledge that risks to this outlook are for later and fewer cuts still.

Markets reflected this shift. Where markets had been increasingly seeing the chance that the Fed could move later than Jun util today’s release, there was a clear switch to now suggesting that it would likely move later than June. The market had priced a 60% chance of a June rate cut before the release, it now prices just 25% and below 50% chance that the Fed moves in July, now only fully pricing a move by September and envisaging two cuts overall. 2-year and 10-year yields jumped sharply accordingly, 2-year US Treasury yields up 25bp to 4.97% and 10-year up 16bps to 4.51%. The dollar also rose sharply by 0.8% on the release.

Exhibit 1: Developments in core inflation

Source: BLS, April 2024

Exhibit 2: Services ISM points to further services disinflation

Related articles

Why 2030 will be a pivotal moment for the longevity economy

- by ,

- 12 April 2022 (7 min read)

Top ESG equities show their resilience in 2021

- by

- 11 February 2022 (5 min read)

What will it take?

- by

- 06 May 2024 (10 min read)

Brick by Brick: Unravelling China's property Puzzle

- by

- 02 May 2024 (10 min read)

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.