India - a bright spot in emerging markets

- 14 November 2023 (5 min read)

Key points:

- India’s gradualist approach to reform is providing the basis for sustained growth.

- The economy is now the fifth-largest globally and on track to become third-largest by the mid-2020s.

- We see the US dollar bond market as an easy way to gain exposure to India

India’s gradualist approach to reform has borne fruit over the past decade, contributing to an easing of fiscal constraints while providing the basis for sustained growth. A prime example of positive reform is the rollout of the Goods and Services Tax in 2017, which has widened the tax base and simplified the tax structure. The reduction in the corporate tax rate, meanwhile, from 30% to 22% in 20191 , has aligned tax rates with Asian peers and boosted the competitiveness of the country.

Other measures adding to this sense of change include:

- Changes to bankruptcy law since 2016

- The start of labour market reform, with the amalgamation of 29 different labour laws into four codes

- The creation of land banks through land acquisition by public bodies which has made it easier to acquire land for large projects

- Financial sector reforms

- Increased digitization that is improving administration efficiency.

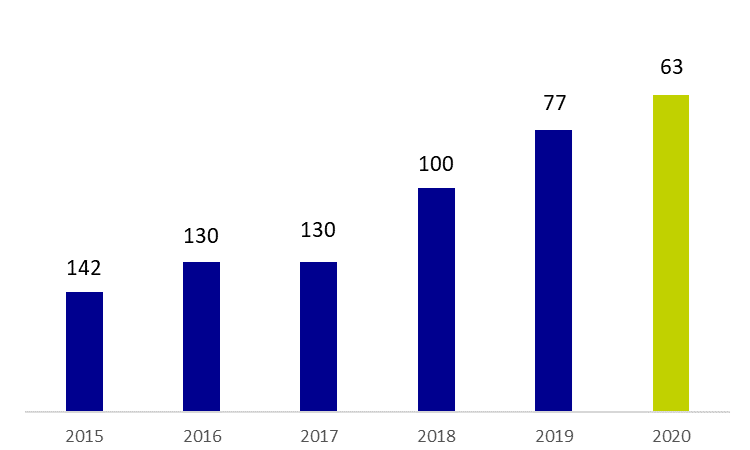

These have all contributed to a fall in the cost of doing business in India (see Figure 1).

Figure 1: India’s Ease of doing business ranking has improved

Source: World Bank, UBS, September 2023

Concurrently, there has been a massive overhaul of infrastructure in the country that has improved productivity and reduced logistical barriers. Examples include:

- National highways have doubled

- Renewable power generation has quadrupled2

- Railway electricifcation has seen a seven-fold increase2

- Upgrade of public digital infrastructure upgraded

In 2020, India launched the Production Linked Incentive Scheme, offering tax benefits for increased production across 14 sectors. This has helped to put India at the forefront of destinations for international firms to relocate out of China.

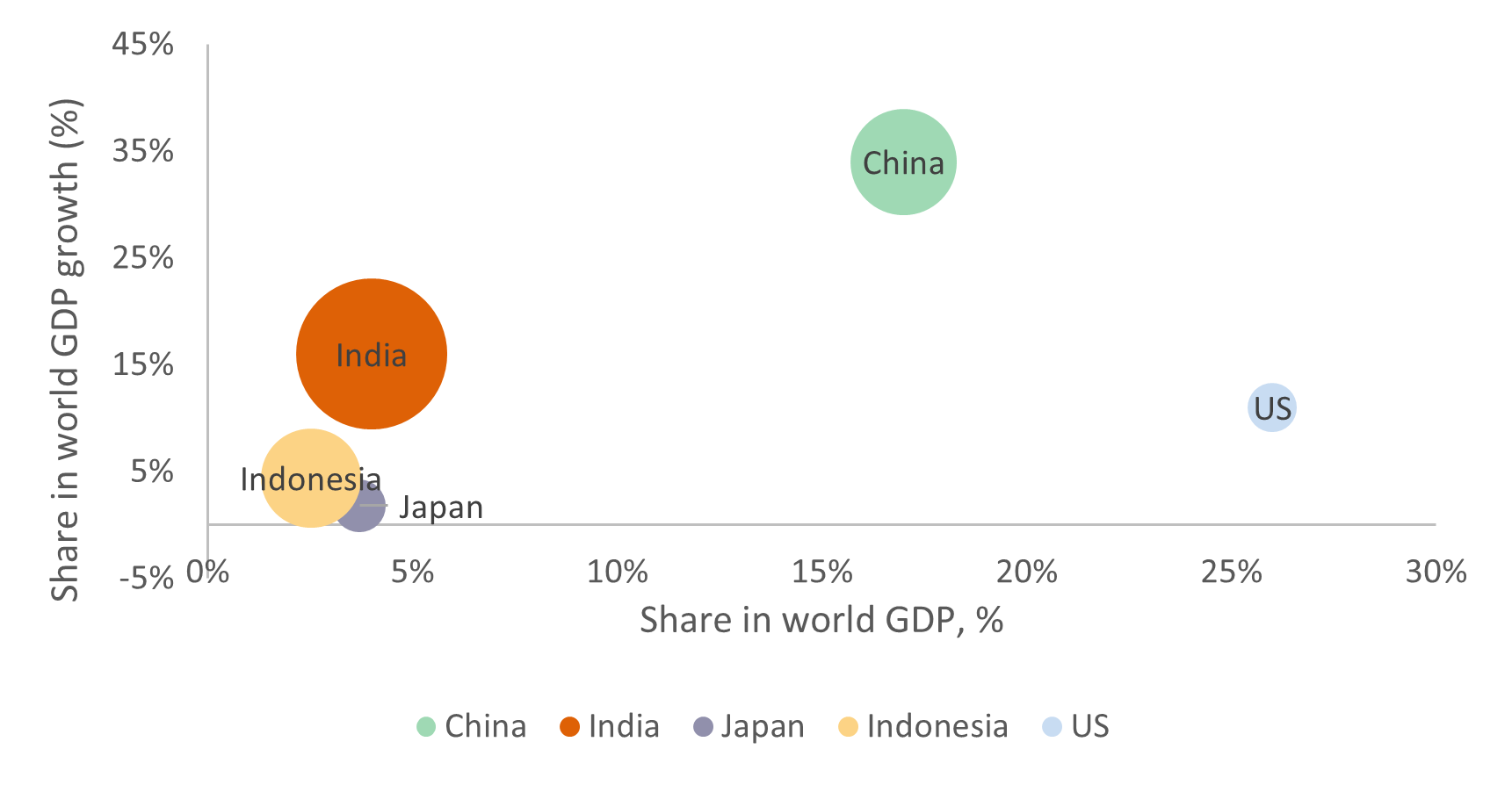

On track to be one of the world's biggest economies

Results have begun to show. The Indian economy is now the fifth-largest in the world, and on track to become the third-largest by the middle of the 2020s. Foreign direct investment inflows have accelerated sharply to be consistently above $40bn annually from 2015-20223 . The push for public capital expenditure has helped set the stage for a private investment cycle, supported by improved bank and corporate balance sheets.

Figure 2: Contributors to world growth in 2023 (estimated)

Source: AXA IM, IMF, UBS estimates, September 2023

Macro stability has been instrumental in that success. Gradual medium-term fiscal consolidation has allowed the Reserve Bank of India (RBI) to strike a balance between growth support and inflation control, with monetary tightening required by its inflation target more contained than in previous cycles.

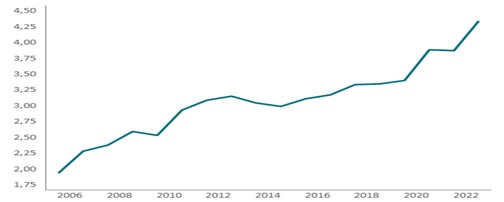

The largest improvement has been on the external front, also contributing to macro stability. India’s share in global services exports (approximately 5%) has more than doubled over the past 15 years and that of goods exports (approximately 1.9%) has also shown progress (see Figure 3).

Figure 3: Global share of India’s service exports (%)

Source: Macrobond, AXA IM – Real Assets, data as at September 2023

The service balance shows a sizeable structural surplus, which limits the sensitivity of the current account balance to faster domestic demand or higher oil prices. More recently, India has been protected from the impact of the war in Ukraine by its access to discounted Russian oil. The current account deficit has narrowed to a sustainable range of 1% to 2.5% of GDP4 , a far cry from the peak 5% deficit a decade ago.

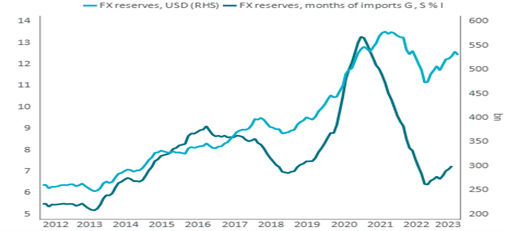

The RBI has built a war chest of foreign currency reserves ($530bn, seven months of total imports), allowing it to smooth excessive currency volatility.

Figure 4: Foreign currency reserves

Source: Macrobond, AXA IM – Real Assets, data as at September 2023

Improving access to international financial markets

International borrowing has been kept in check and external debt metrics compare favorably with India’s credit peers. The upcoming inclusion of Indian local currency government bonds in the JP Morgan GBI EM index marks another milestone in India’s journey to deeper financial markets and increased access to international savings.

Figure 5: External debt as a % of exports goods, services and income

Source: Macrobond, AXA IM – Real Assets, data as at September 2023

The dollar bond market provides a straightforward way to gain exposure to India, as there is a broad range of companies and public sector entities that have dollar bonds outstanding. Approximately 100 issuers from the country have issued US dollar bonds with a total outstanding of around $150bn5 .

Within that opportunity set, we believe that companies operating in the renewable energy sector best fit our commitment to responsible investing and we hold these across portfolios. Looking at performance, the country subindex in the JP Morgan Emerging Market Corporate subindex outperformed the broad benchmark year-to-date (3.4% versus 2.1%6 ) and we believe there are still pockets of value.

Overall, we believe India is a bright spot in emerging markets globally and the country represents a core holding across our portfolios.

- U291cmNlOiBXb3JsZCBCYW5rLg==

- U291cmNlOiBHb3Zlcm5tZW50IG9mIEluZGlh

- U291cmNlOiBHb3Zlcm5tZW50IG9mIEluZGlh

- U291cmNlOiBDRUlD

- U291cmNlOiBDRUlD

- U291cmNlOiBCbG9vbWJlcmcsIEFYQSBJTQ==

- U291cmNlOiBCbG9vbWJlcmcsIEpQTSBpbmRpY2VzIGFzIGF0IDMxIE9jdG9iZXIgMjAyMw==

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.