Why ETF investors should not overlook active fixed income

- 13 March 2024 (5 min read)

Flows into European ETFs last year remained dominated by equity ETFs, but with record flows for 2023, fixed income ETFs are quickly gaining ground.1 This year has so far continued the trend of positive flows, for example with January 2024 seeing an increased appetite for European corporate high yield. This is after record inflows into this segment in the Q4232 .

With investors increasingly seeking the opportunity to apply the potential benefits of an ETF vehicle beyond traditional indexed equity, there’s good reason to believe fixed income ETFs can maintain this momentum through 2024 and beyond. Of course, much of that will depend on the fixed income market environment.

Opportunities to put cash to work in fixed income

A substantial pool of liquidity, housed in money market funds looms over the financial markets. An examination of previous economic cycles indicates that this robust preference for liquidity is likely to diminish at some stage, particularly if the European economy steers clear of a severe recession and the European Central Bank (ECB) edges closer to rate cuts. Investor reallocations could unleash a flood of cash into risk assets.

Nonetheless, the timing of this shift and the specific asset classes that will benefit from it will hinge on several variables that are challenging to predict, such as the trajectory and pace of future ECB policy actions, persistent inflationary pressures, risks to economic expansion, and, notably, investor behaviour in the midst of uncertainty.

Our primary assessment is that cash seeking higher returns is likely to flow into shorter-term bonds, attracted by appealing yield levels and the potential for price appreciation as yields decline.

- U291cmNlOiZuYnNwO0xTRUcgTGlwcGVyOiBFdXJvcGVhbiBFVEYgSW5kdXN0cnkgUmV2aWV3IDIwMjMu

- U291cmNlOiBFVEYgQm9vaywgQVhBIElNIFByb2R1Y3QgSW50ZWxsaWdlbmNlLCBhcyBvZiAzMS8wMS8yMDI0

Why consider an active approach to fixed income ETF investing?

Fixed income is set to be a major priority for investors seeking to navigate a demanding market landscape in 2024. For those reassessing their fixed income allocations, utilising active fixed income management via an ETF structure offers investors diversification, liquidity, transparency and a cost-effective method for portfolio construction.

Furthermore, in the ETF space, the discussion surrounding active versus passive management becomes particularly prominent during periods of interest rate adjustments.

Active managers possess the capability to actively react to economic fluctuations and policy announcements, potentially maximising capital gains. In a volatile market, active bond management enables the portfolio manager to swiftly adjust their portfolio as economic indicators evolve and central banks alter their stance on interest rate policies. For example, sector allocation can be guided by the investment team's capacity to identify relative value opportunities within the investment universe, potentially creating significant value over time

Where in Fixed Income can ETF investors find opportunities?

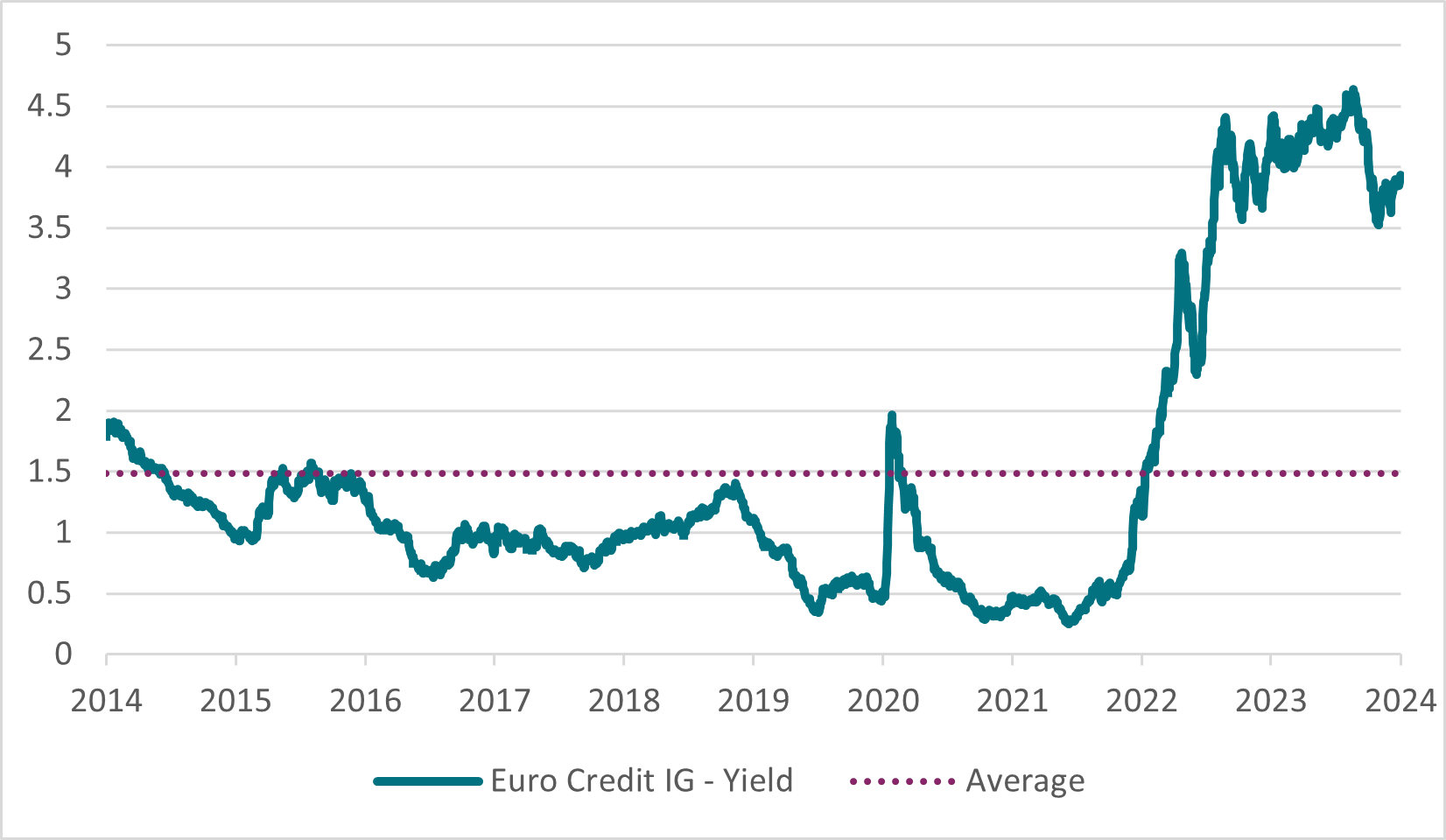

For ETF fixed income investors, European credit looks well-placed to offer opportunities in 2024. As the chart below shows, valuations continue to remain attractive as Euro Credit IG index delivers about 4% yield3 , which is close to the 2023-highs of 4.5% and still above the 10-year historical average.

Yield of Euro Credit IG index %

Source: AXA-IM, Bloomberg as of 29 February 2024

Second, fundamentals remain resilient and if there is a soft landing, we believe that the investment grade (IG) asset class should resist. We have seen some deceleration in trends since Q3 2023, and this deceleration will continue in the coming quarters. Finally, the yield attractiveness of the asset class has been a strong support for credit markets, resulting in significant inflows and the easy absorption of primary issuance in 2023. 2024 has already started on a positive footing with inflows accelerating in Euro Credit IG strategies, showing the attractiveness of credit markets over risk-free or low risk products.

- U291cmNlOiBCbG9vbWJlcmcgYXMgb2YgMjkgRmVicnVhcnkgMjAyNA==

Related articles

Why 2030 will be a pivotal moment for the longevity economy

- by ,

- 12 April 2022 (7 min read)

Top ESG equities show their resilience in 2021

- by

- 11 February 2022 (5 min read)

Causes and FX

- by Gilles Moëc

- 29 April 2024 (10 min read)

Japan reaction: Cautious stance from the BoJ

- by

- 26 April 2024 (3 min read)

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.