Why Inflation-linked bonds are “persistently” attractive

- 18 August 2023 (3 min read)

Key points:

- Despite the disinflation process, the outlook for inflation remains volatile

- Interest rates are in restrictive territory

- Inflation-linked bonds continued to outperform their nominal counterparts and still offer a good trade off between duration and sticky inflation

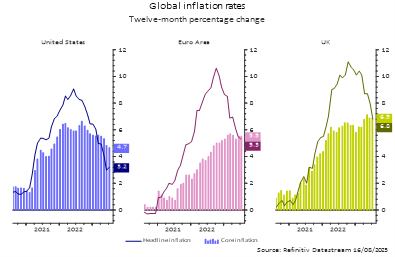

After last year’s peak, total inflation has been falling across advanced economies mainly result of lower oil prices. However, core inflation is stubbornly above the 2% target, giving central banks (and fixed income investors) a hard time.

No doubt market sentiment has been dominated by two different themes in 2023: inflation persistence and the timing of the end of the hiking cycle. Multiples are the reasons behind the stickiness in inflation: tighter labour markets, consumer spending resilience, higher fiscal deficits, ongoing supply chain disruptions. Also, the recent uptick in commodity prices is adding upside risks to headline inflation in the short term: the outlook remains volatile, even if we don’t expect inflation to materially reaccelerate.

Source: AXA IM, Refinitive Datastream as of 16 August 2023

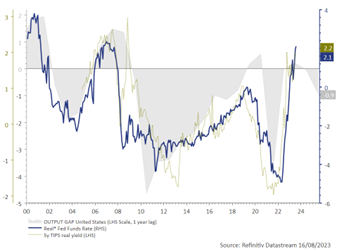

Central banks across advanced economies have in consequence pursued the fight against inflation, hiking rates by at least another 100 bp this year. In our view, this additional tightening has brought interest rates into restrictive territory. Real yields are now in positive territory for the first time since the Great Financial Crisis and the transmission of higher rates into the economy should be translated into subdued growth over the coming quarters, as it has been the case for the past decades.

Source: AXA IM, Refinitive Datastream as of 16 August 2023

In this context, we believe that inflation-linked bonds offer an interesting value proposition. First, as economic activity decelerates, real yields should rally as they are a long-term proxy for real growth. At the same time, with inflation breakevens hovering around 2%-2.5%, it seems that there is little inflation premium in current valuations. We see this market mispricing of future inflation, as an opportunity to lock in higher yields at attractive values while protecting against upside risks for inflation.

Despite higher rates and lower total inflation, inflation-linked bonds have outperformed their nominal counterparts since the beginning of the year1 . We think that investors should continue to allocate to inflation linked bonds in their portfolios as a capital preservation strategy as they provide resilience against sticky inflation and will also benefit from looming economic outlook

- QnJlYWtldmVuIHBlcmZvcm1hbmNlIGluIHRoZSBnbG9iYWwgYWxsIG1hdHVyaXRpZXMgdW5pdmVyc2UgaXMgKzAuNDAlIGFzIG9mIEF1Z3VzdCAxNnRoICpSZWFsIEZlZCBmdW5kIHJhdGUgaXMgY2FsY3VsYXRlZCBieSBzdWJzdHJhY3RpbmcgdGhlIFVuaXZlcnNpdHkgb2YgTWljaGlnYW4gMXllYXIgaW5mbGF0aW9uIGV4cGVjdGF0aW9ucyBmcm9tIHRoZSBjdXJyZW50IEZlZCBmdW5kcyByYXRl

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.