Act for human progress by investing for what matters

Invest with purpose to support the transition to a more sustainable economy

Why ACT?

Environmental impact range designed to deploy investment capital positively towards sustainable solutions including smart energy and low carbon transportation, sustainable industry and agriculture, recycling and waste reduction and water scarcity. These themes pursue long-term growth potential arising from the global urgency to tackle climate change and biodiversity loss.

Clean Economy

Address pressures on natural resources and greenhouse gas emission.

Socially responsible strategies which recognise we live in an unequal global society and seek to drive change, progress, and empowerment through the key themes of improving access to education, human capital and diversity, health & wellbeing, financial & tech inclusion, and housing & essential infrastructure.

A flexible approach across asset classes that seeks to improve prosperity for people and planet by investing in a broad range of impact themes such as empowerment, health & wellbeing, inclusion, resource scarcity, sustainable industry and energy transition.

Multi-asset impact investing

Support the companies and projects addressing social and environmental challenges.

Visit the fund centre

Visit our fund centre to find out more about our people and planet strategies.

Risks

No assurance can be given that our strategies will be successful. Investors can lose some or all of their capital invested.

Stewardship and Engagement

Find out more about our engagement to drive action and create meaningful impact.

Discover our approachOverview

Investing in companies and projects that are leading the way to a more sustainable and just world not only powers the transition to a net-zero economy but also aims to ensure no one is left behind in that transition, as well as providing the potential to deliver more sustainable financial returns over the long-term.

Our ACT range is our most focused ESG offering. Alongside financial returns, the range aims to target specific sustainability goals around people and planet. Investment decisions are guided by both the financial goals and either ESG themes or measurable, positive impact.

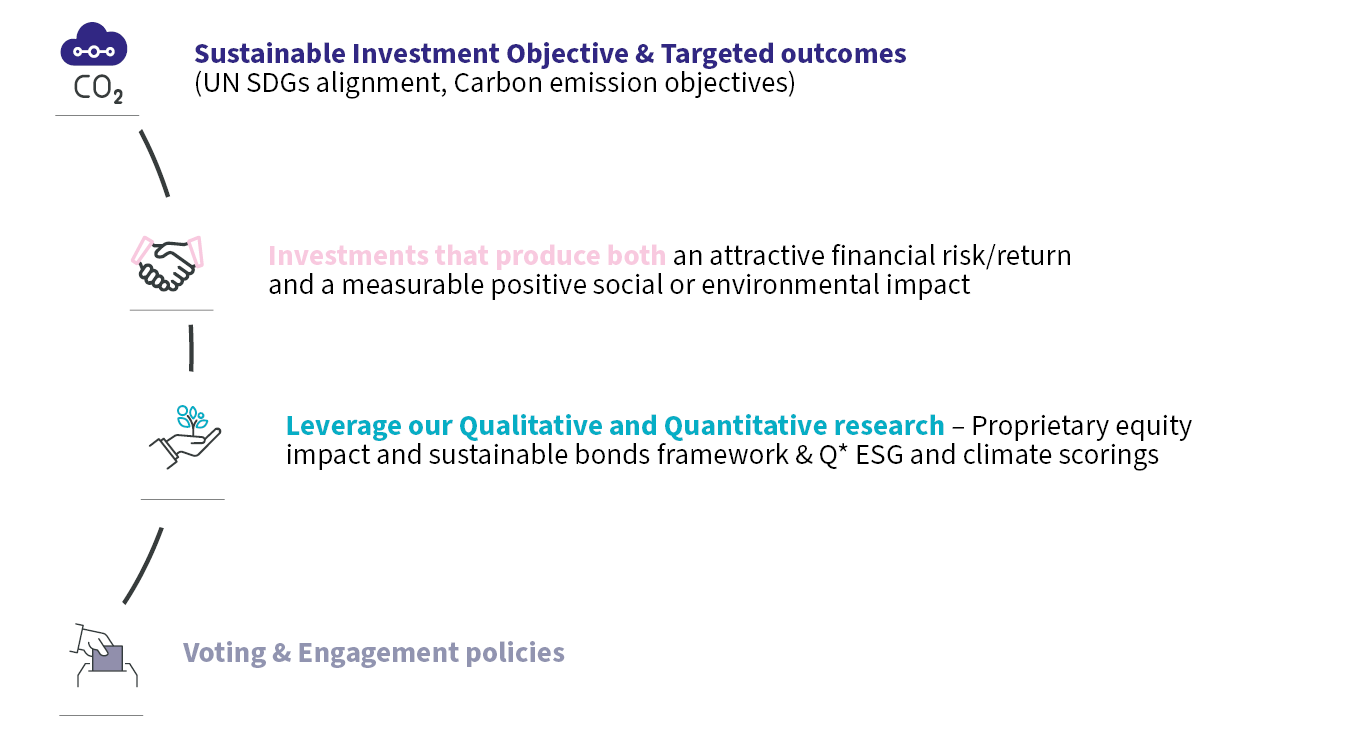

A common framework

All strategies in the range apply the same key principles which form a common framework underpinning the range, as shown below:

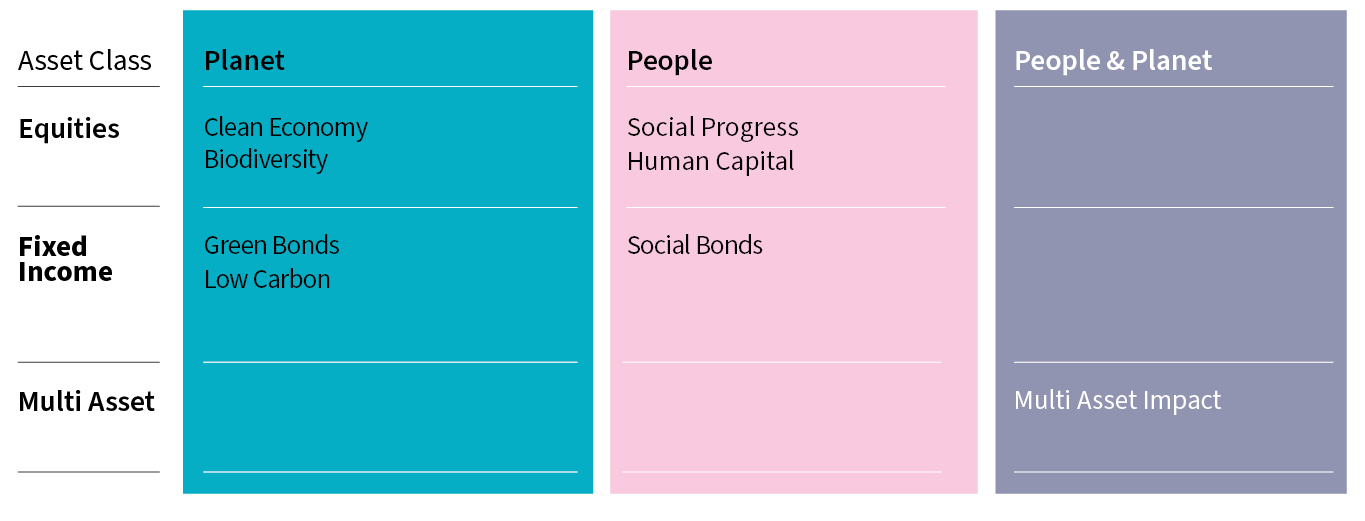

A comprehensive range

ACT strategies invest for concerns related to either the environment (planet), society (people) or both, across AXA IM Core’s asset classes – equities, fixed income and multi asset.

Strategies that support prosperity for the planet and tackling climate change, covering aspects such as smart energy and low carbon transportation, sustainable industry and agriculture, recycling & waste reduction and water scarcity.

Clean economy

Innovative companies are creating solutions to address pressures on scarce natural resources and the need for greenhouse gas emission reduction.

Green bonds

Green bonds are among the most interesting innovations of the last decade in the field of socially responsible investment products.

Multi-asset impact investing

A world of opportunities to help create a positive impact for people and planet while generating returns.

US high yield low carbon

We believe the global economy has entered a ‘decade of transition’ towards a more sustainable, de-carbonised model.

Strategies that support prosperity for people, covering aspects such as education, human capital and diversity, health & wellbeing, financial & tech inclusion, and housing & essential infrastructure.

Social progress

Invest in the companies providing strong social utility by making essential products and services better quality, more affordable and more accessible to all.

Social bonds

Rapid growth in the social bonds market offers a compelling opportunity to invest in the social dimension of the transition to a low carbon economy.

Risks

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (AXA IM) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA IM in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA IM excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA IM is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA IM is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA IM does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd.