Pick your poison: Geopolitics or AI

If it’s not geopolitical shocks roiling markets it is artificial intelligence, either because AI is a bubble, or because it is decidedly not but it will instead wreak havoc across business models and the labour market.

The news over the last week has highlighted different aspects of AI’s disruptive power. Announcements of even greater capital expenditure from companies such as Google’s owner Alphabet point to lower margins. The increasing availability of open-source AI tools means that revenues for competitors will be lower (weakening the justification for high capital expenditure). The extent of the impact on the labour market and consumer demand of AI’s creative destruction, as the skills of professionals suddenly become far less valuable and jobs are lost, is difficult to quantify.

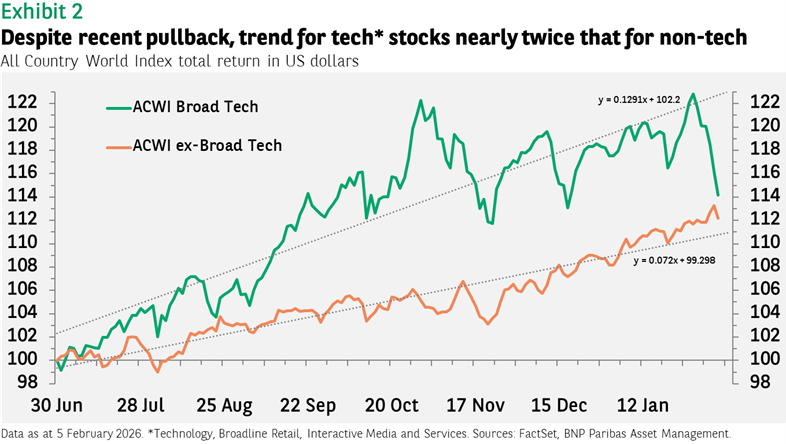

AI’s newness as a market factor, alongside the fierce competition within the industry, means these sorts of surprises are to be expected (remember DeepSeek?). Since last summer, technology sector volatility has been twice as high as for the rest of the market.

It will take time for analysts to assess the net impact of all these factors and for earnings expectations to adjust, hence caution in the short term is in order. Nearly half of the companies in the Nasdaq 100 index have yet to announce their results. While earnings growth for those companies already reporting look strong, 11% in aggregate, that is only in line with expectations, when investors are accustomed to larger positive surprises each quarter (for the S&P 500, earnings growth is higher (14%) as are surprises (8%), helping to explain why non-tech stocks are outperforming).

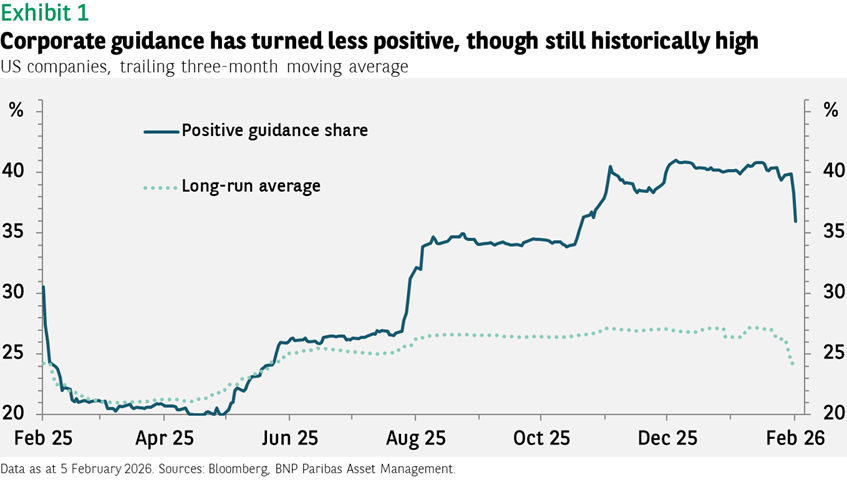

In addition to disappointing results, CEOs are becoming less upbeat about the future. The share of positive guidance provided by companies has fallen back, though it is still at an historically high level (see Exhibit 1).

Even if it is wise to be cautious tactically, we are still optimistic strategically. Along with the volatility in tech stocks have come superior returns (though admittedly not recently). Since last summer the slope of the trend line for global tech stock performance is nearly twice as high (see Exhibit 2).

While the earnings growth rate for tech stocks may be revised downwards, it is still likely to be far better than that for non-tech stocks. Currently, tech profits are expected to rise 31% this year compared to just a 10% gain for non-tech stocks (2025 rates are 26% and 6%, respectively). The size of that gap means it will be difficult for non-tech stocks to sustainably outpace tech stocks without a significant deterioration in the outlook for the latter’s profits, or a reduction in the multiple on tech earnings.

The valuation risk is arguably greater for value stocks than for tech. The z-score1 for the forward price-earnings (P/E) ratio for the Nasdaq 100 is 0.2, while the ratio for emerging market tech stocks is at its long-run average (a z-score of zero). The score for some value indices, however, is far higher. The MSCI Japan index and the Russell 1000 Value index have P/E z-scores of 1.8. The partial exception is Europe, where the score is 0.5, a decent amount above average but not extreme.

Recent events simply reinforce the importance of diversification in tech sector exposure across industries and regions (both developed and emerging). While always valuable for a portfolio, it is all the more critical given the rapid developments in the tech industry. Almost any player can be disrupted, but the likelihood is that the disruptor will be somewhere else within the index. Losses on any one stock should be compensated by gains in another and aggregate earnings should continue to rise.

- A measure of the current value of a metric relative to the long-run average, scaled for volatility. The more a z-score is above zero, the higher the metric is above average.

Tail risks

The recent surprise in the January US manufacturing sector ISM index, which jumped to 52.6 (expansionary territory) after 10 months of sub-50 readings, highlights one of the risks to the positive outlook for US equities this year. GDP growth has averaged 4.1% over the last two quarters and the Atlanta Fed’s GDPNow estimate stands at 4.2%, well above the potential long-run growth rate of the economy (around 1.8%). Given that inflation may move back up in the months ahead as shutdown and weather distortions fade, it may be challenging for the Federal Reserve to deliver the two cuts in the fed funds rate that markets expect. Much will depend on labour market developments, with labour supply increasing as companies lay off workers and replace them with AI tools, while supply is simultaneously shrinking thanks to deportations. The adjustment of equity markets to fewer (or no) cuts from the Fed would likely be painful as the increase in the discount rate pushes down the multiple, particularly for tech and small cap stocks. Once the adjustment has been made, however, the outlook for strong economic growth and slightly higher inflation would likely support subsequent gains in markets.

Performance data/data source: Bloomberg, FactSet, BNP Paribas Asset Management, as of 5 February 2026, unless otherwise stated. Past performance should not be seen as a guide to future returns.

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)

__________________________________________________________________________

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.