Take Two: Eurozone GDP expands in Q4; Japan stocks surge to new high

What do you need to know?

The Eurozone economy grew 0.3% in the fourth quarter, a second official estimate showed – in line with the previous estimate and Q3’s 0.3% growth. That put annual growth for the bloc at an estimated 1.5% for 2025 as a whole, compared to 0.9% for 2024. Separately, European artificial intelligence and defence technology start-ups saw a significant increase in investment activity last year, as total European venture capital investment rose 5% year-on-year to €66 billion, according to Pitchbook. AI-related deals accounted for over 35% of total European venture capital transactions last year, at some €23.5 billion.

Around the world

Japan’s stock market climbed to a new record high last week following Prime Minister Sanae Takaichi’s decisive win in a snap general election on 8 February. Investors hoped the success of Takaichi’s Liberal Democratic Party would help advance an economic stimulus package consisting of several pro-business measures. The election result gave the LDP a two-thirds supermajority in the lower house, the first such result for a single party since Japan’s parliament was established in its current form in 1947. Elsewhere, China’s consumer price index measure of inflation slowed in January to 0.2% year on year, from 0.8% in December, and below expectations.

Figure in focus: $660bn

Capital expenditure on data centres and artificial intelligence infrastructure is set to reach around $660 billion from just four ‘big tech’ firms this year, according to reports. Amazon, Google owner Alphabet, Microsoft and Meta Platforms laid out their planned investment spending alongside their recent quarterly results. This could mean they issue more corporate bonds – Alphabet notably issued a 100-year bond last week – or raise funds in equity markets, dip into cash reserves or return less cash to shareholders, analysts believe. Concerns over whether the spending plans will pay off in terms of AI’s earnings potential were partly behind the recent tech stock volatility.

Chart of the week

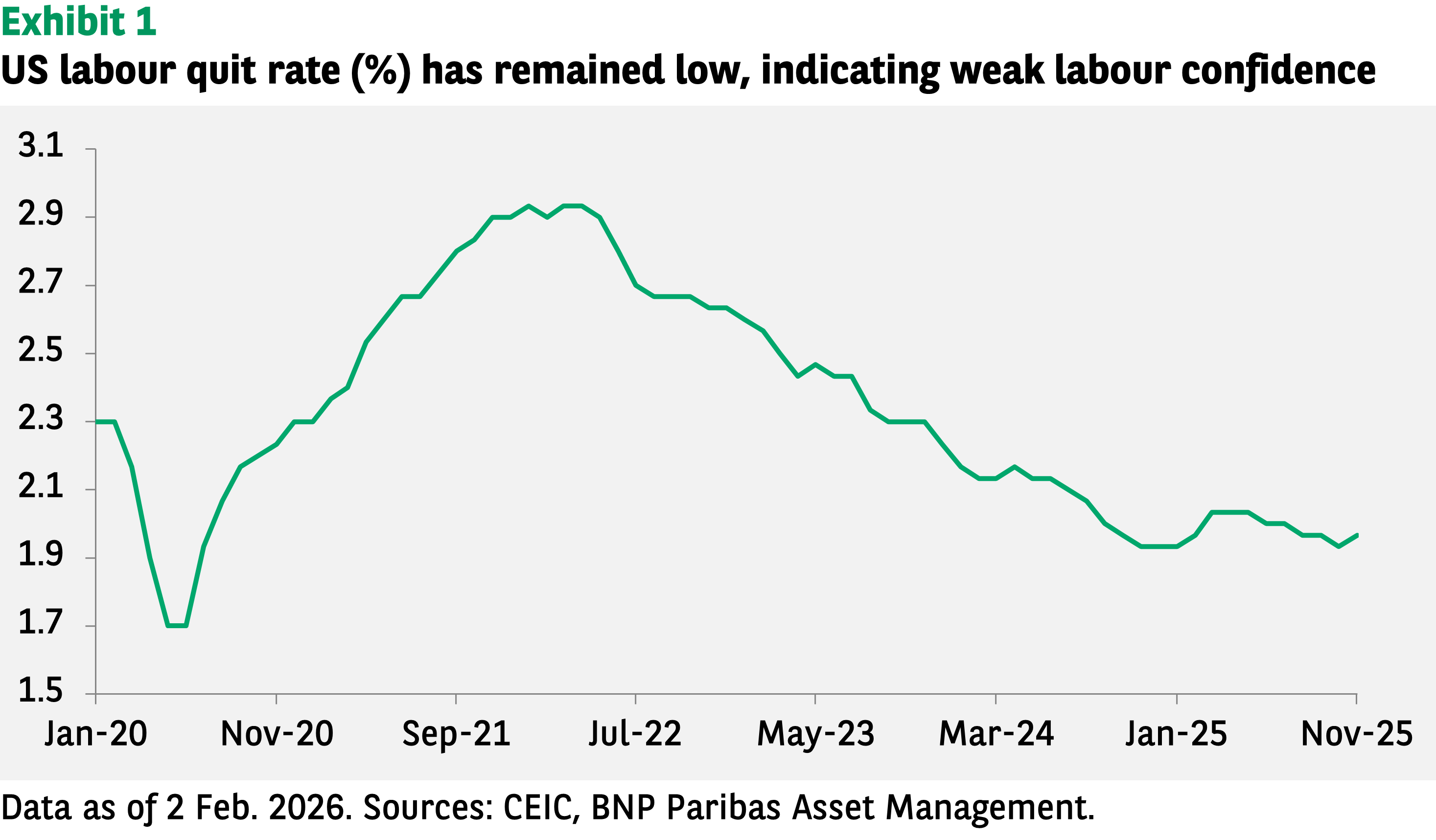

January’s better-than-expected non-farm payroll data was the latest sign of a stabilising US labour market. However, the job gains were narrowly based, echoing other evidence that hiring was sluggish and job security was eroded. These signs indicate weak confidence, as reflected in the low 2% quit rate – suggesting workers are hesitant about voluntarily leaving their jobs as they have little faith in finding new work.

AI-driven productivity gains are curbing demand for labour, raising the prospect of a jobless expansion. In the face of weakening employment prospects and low confidence, the US economy’s resilience could soon be put to the test.

Words of wisdom

Water bankruptcy: A severe, persistent water shortage where damage to key parts of the system such as wetlands and lakes is irreversible. The world has “moved beyond a water crisis and into a state of global water bankruptcy”, according to a recent United Nations report. Around four billion people now experience severe water scarcity for at least one month each year, while the impact of droughts costs around $307 billion annually, it said. Meanwhile more than half of the world’s large lakes have declined since the 1990s and around 35% of natural wetlands have been lost since 1970. The UN urged action to protect natural resources and invest in rebuilding.

What’s coming up?

On Monday, Japan issues a preliminary estimate for fourth quarter GDP growth. Tuesday sees the Eurozone publish the latest ZEW Economic Sentiment Index and Canada reports inflation data, followed by the UK on Wednesday. Also on Wednesday, the Federal Reserve publishes the minutes of its latest meeting where it voted to keep rates on hold at 3.5%-3.75%. Friday sees flash Purchasing Managers’ Indices published, covering Japan, the Eurozone, UK and US.

Read more insights at the Investment Institute

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)

__________________________________________________________________________

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.