Take Two: Fed keeps interest rates on hold; gold price hits new record

What do you need to know?

The Federal Reserve left its benchmark interest rate unchanged for the first time since July, at a range of 3.5% to 3.75%, as the US economy continued to expand “at a solid pace”. The Fed highlighted that the unemployment rate has shown some signs of stabilisation, giving rise to expectations that it will keep rates on hold for longer. It warned however that there was still uncertainty around the economic outlook, and two of the 12-member Federal Open Market Committee voted in favour of another 25-basis-point cut. Elsewhere, the Eurozone economy expanded by 0.3% in the fourth quarter of 2025, matching Q3’s rate, according to a preliminary flash estimate.

Around the world

The price of gold surpassed $5,500 per ounce last week - just days after crossing the $5,000 threshold – on the back of geopolitical tensions and concerns over Japan’s fiscal position. Japan’s Prime Minister, Sanae Takaichi, has proposed tax cuts which some investors fear could increase the country’s already high debt. Meanwhile trade tensions and a weaker US dollar have prompted investors to buy the yellow metal, often perceived as a ‘safe haven’ asset. Commodity prices helped the UK’s FTSE 100 index also touch a fresh high last week, while the S&P 500 passed 7,000 points for the first time on Wednesday following strong technology firm earnings updates.

Figure in focus: $100bn

Investment into global clean fuel will need to quadruple to at least $100bn annually by 2030 to meet global clean energy targets, according to a report from the World Economic Forum and Bain & Company. The report said clean fuels – including biofuels and lower-carbon fossil fuels - can present significant opportunities for economic growth, social development and energy security, helping to reduce import dependence on fossil fuels by 5% to 15%. Separately, wind and solar produced more power than fossil fuels in the European Union for the first time last year, providing 30% of electricity, according to energy think tank Ember.

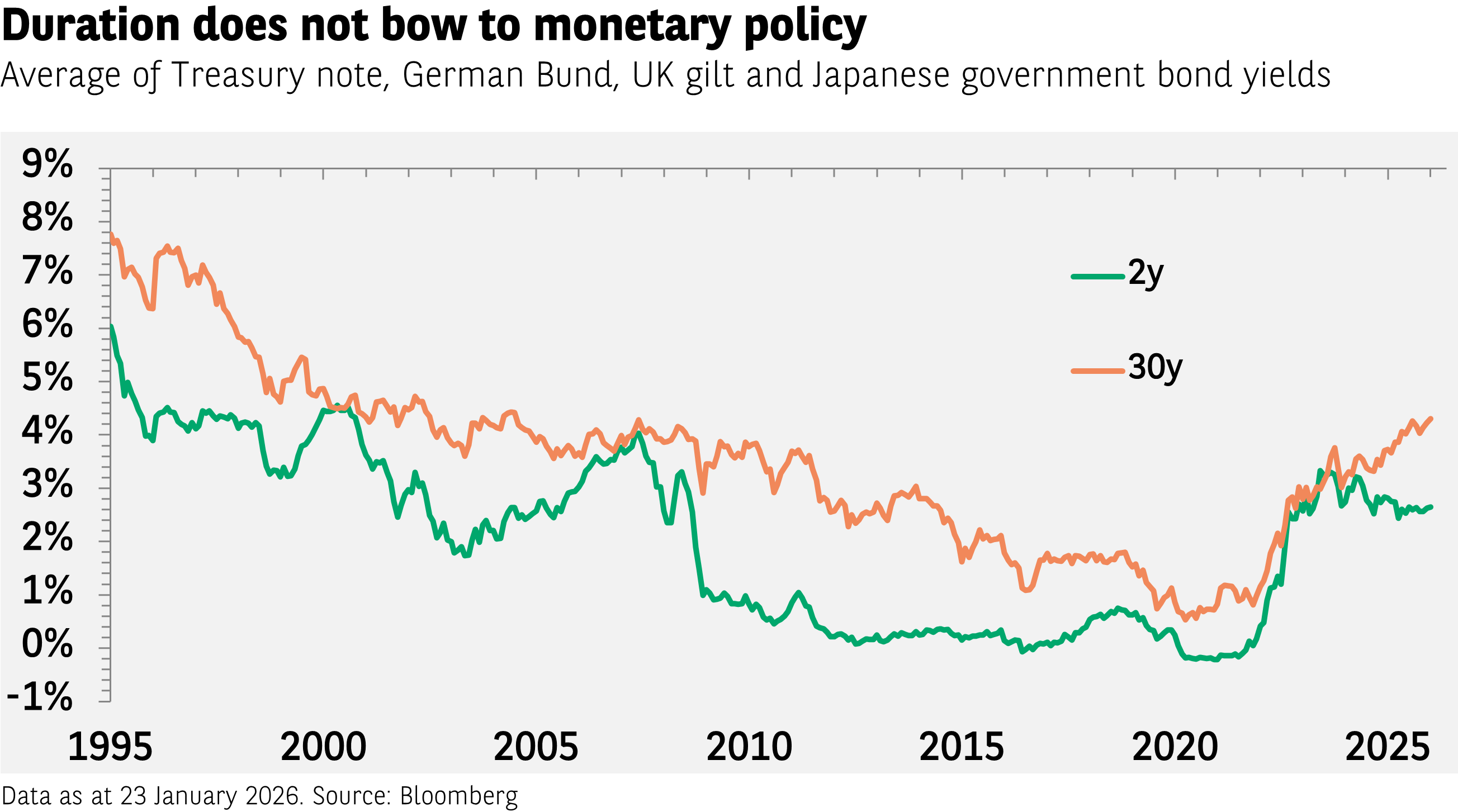

Chart of the week

According to the general consensus, investors appear to have quite a bullish outlook, and this is reflected in portfolio allocations. While geopolitical uncertainty has picked up again since the start of 2026, investors seem convinced that the global economy will prove resilient in the face of unpredictable shocks and that monetary policy will do whatever is needed to buffer any short-term deterioration in financial conditions. However, while central banks have cut interest rates over the past 12 months, long-dated bond yields have increased, notably in Japan, highlighting investor concerns over long-term government debt.

Words of wisdom

Physical AI: A type of artificial intelligence that can make decisions autonomously and perceive, reason and act in the real world through machines like robots or consumer electronics. January’s Consumer Electronics Show, a leading technology trade event, featured several examples of physical AI, from smart glasses to gaming consoles that incorporate users’ movements and humanoid robots that can sort and fold laundry. The technology can also learn from seeing people perform tasks and respond to changing circumstances, helping make the deployment of skilled robots more viable and potentially expanding the AI market into new devices and systems.

What’s coming up?

On Monday, the Bank of Japan publishes its Summary of Opinions, including its expectations for inflation and growth. On Tuesday, the Reserve Bank of Australia meets to decide on interest rates. Wednesday sees final Purchasing Managers’ Indices released for markets including Japan, China, the Eurozone and US, as well as a flash estimate for Eurozone inflation. On Thursday, both the Bank of England and the European Central Bank hold their respective policy meetings to set interest rates. The US and Canada release jobs data on Friday.

Read more insights at the Investment Institute

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)

__________________________________________________________________________

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.