Take Two: ECB keeps rates on hold as inflation dips; markets endure volatility

What do you need to know?

The European Central Bank kept interest rates steady at 2% as Eurozone annual inflation eased to 1.7% in January, from 2.0% the month before. The fall was chiefly driven by lower energy costs, while the core measure, excluding energy, food, alcohol and tobacco, fell to 2.2% from 2.3%. The Bank of England held interest rates at 3.75%, though four of its nine policymakers voted for a 25-basis-point cut. The BoE lowered its UK growth forecast to 0.9% from 1.2% for 2026 and 1.5% from 1.6% for 2027. In contrast, the Reserve Bank of Australia raised rates by 25bp to 3.85%, its first hike in over two years.

Around the world

Markets endured another bout of volatility last week as concerns about the impact of new artificial intelligence offerings on established players and plans for increased AI spending weighed on technology stocks. Over the week to Thursday’s close, the tech-heavy Nasdaq Index was down by 5%, while the MSCI World NR Index fell by 2%*. Gold - often viewed as a so-called ‘safe haven’ during periods of turbulence – also saw its price fall before rebounding over renewed US-Iran tensions and weak US jobs data. Elsewhere, the UK’s blue-chip FTSE 100 index hit a fresh high.

* In US dollar terms. Source: FactSet, data as of 5 February 2026

Figure in focus: 53.0

US business activity expanded in January with stronger output in both its manufacturing and services sectors. The composite Purchasing Managers’ Index rose to 53.0 from 52.7 in December - a reading above 50 indicates expansion. Meanwhile, Japan’s business activity expanded at its quickest pace since May 2023 with its composite PMI rising to 53.1 from 51.1, boosted by higher factory production. However, Eurozone business activity slowed slightly, reaching a four-month low. The bloc’s composite index eased to 51.3 from 51.5 as new orders only rose slightly and employment stagnated.

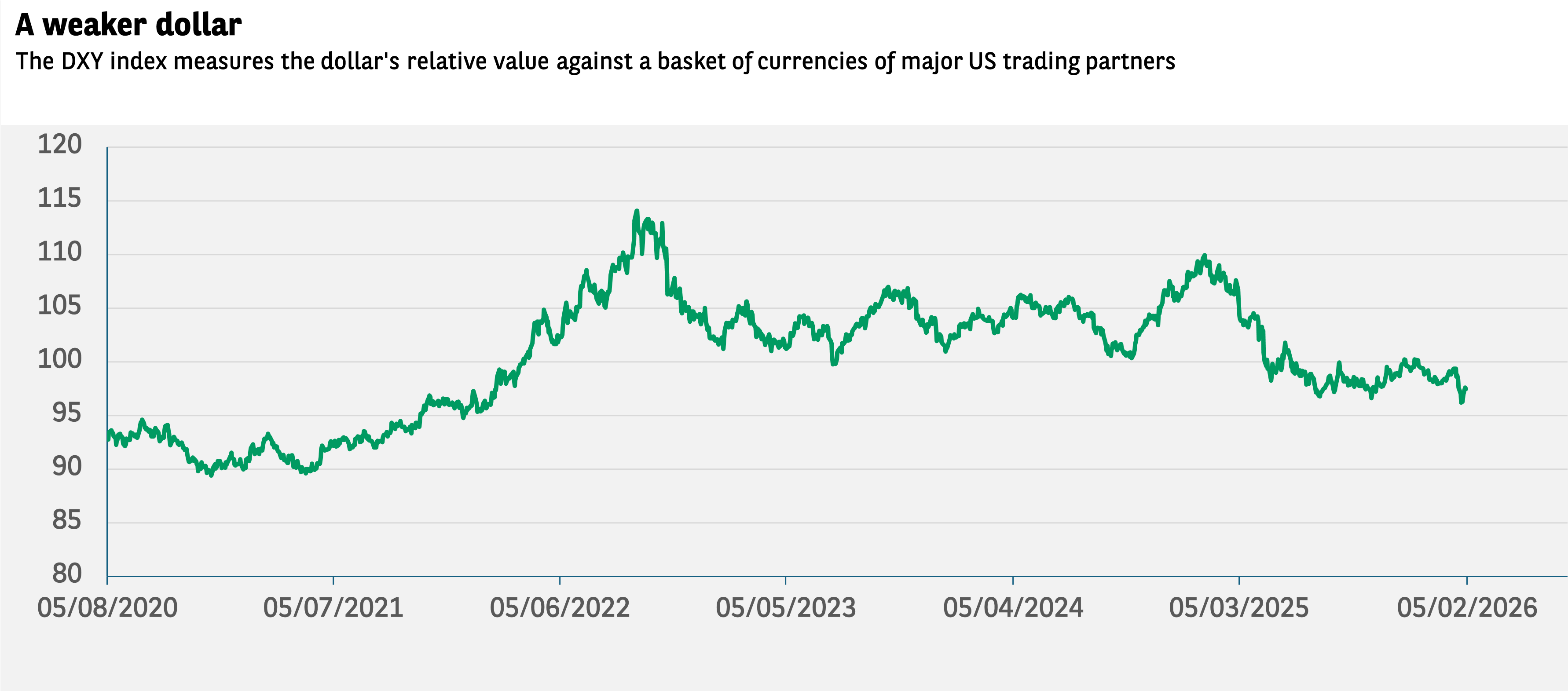

Chart of the week

The US Dollar Index (DXY) plots the greenback’s value against a range of US trade partners’ currencies. The index goes down when the US dollar weakens (i.e. loses value) versus other currencies. It has fallen over 10% in the 12 months through January. Investors have been diversifying away from the dollar partly due to concern over the US government’s economic policies but also to take advantage of opportunities outside the world’s largest economy and further diversify balanced portfolios.

Source: Bloomberg, BNP Paribas Asset Management; February 2026

Words of wisdom

Project Vault: A new US government initiative to create a reserve of critical minerals to protect manufacturers from supply shocks and support US production. The project will initially be funded by the US Export-Import Bank - the country’s official export credit agency - which will provide a $10bn loan, while a further $2bn will come from private capital. The stockpile would include the purchase of rare earths, copper and lithium, as part of an effort to reduce the dependence on China, which dominates the supply chain for many critical minerals. Last week the US, European Union and Japan also announced they intended to work together to make their critical minerals supply chains more resilient.

What’s coming up?

On Wednesday, China issues its latest inflation data, and the US publishes its delayed job numbers update. Thursday sees the UK report a preliminary estimate for fourth quarter GDP growth, while the Eurozone follows on Friday with a second estimate of Q4 GDP. The previous estimate found the Eurozone economy expanded 0.3% in Q4, matching Q3’s growth rate. On Friday, the US publishes its January inflation rate. In December, US annual consumer price inflation rose 2.7%, matching November’s rate.

Read more insights at the Investment Institute

Disclaimer

The information on this website is intended for investors domiciled in Switzerland.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not liable for unauthorised use of the website.

This website is for advertising and informational purpose only. The published information and expression of opinions are provided for personal use only. The information, data, figures, opinions, statements, analyses, forecasts, simulations, concepts and other data provided by AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) in this document are based on our knowledge and experience at the time of preparation and are subject to change without notice.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) excludes any warranty (explicit or implicit) for the accuracy, completeness and up-to-dateness of the published information and expressions of opinion. In particular, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not obliged to remove information that is no longer up to date or to expressly mark it a such. To the extent that the data contained in this document originates from third parties, AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) is not responsible for the accuracy, completeness, up-to-dateness and appropriateness of such data, even if only such data is used that is deemed to be reliable.

The information on the website of AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group) does not constitute a decision aid for economic, legal, tax or other advisory questions, nor may investment or other decisions be made solely on the basis of this information. Before any investment decision is made, detailed advice should be obtained that is geared to the client's situation.

Past performance or returns are neither a guarantee nor an indicator of the future performance or investment returns. The value and return on an investment is not guaranteed. It can rise and fall and investors may even incur a total loss.

AXA Investment Managers Switzerland Ltd (Part of BNP Paribas Group)

__________________________________________________________________________

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.